For the 24 hours to 23:00 GMT, the EUR rose 0.08% against the USD and closed at 1.1327.

Yesterday, negotiations between the Euro-zone and Greece Finance ministers failed to reach any agreement on extending the bailout plan for Greece. Markets would now be focused on cues from the two day summit of European Union leaders which start today.

In other economic news, current account deficit in France recorded a reading of €1.90 billion in December. The nation had posted a revised current account surplus of €0.30 billion in the previous month.

In the US, mortgage applications fell 9.00% in the week ended 06 February 2015. It had advanced 1.30% in the previous week. Meanwhile, budget deficit in the US widened more than expected to $17.54 billion in January, following a budget deficit of $10.30 billion in the previous year’s same month.

Separately, the Dallas Fed President, Richard Fisher stated that a stronger US dollar and lower global oil prices are a net positive for the US economy. Furthermore, he warned the Fed against delaying a hike in its interest rates.

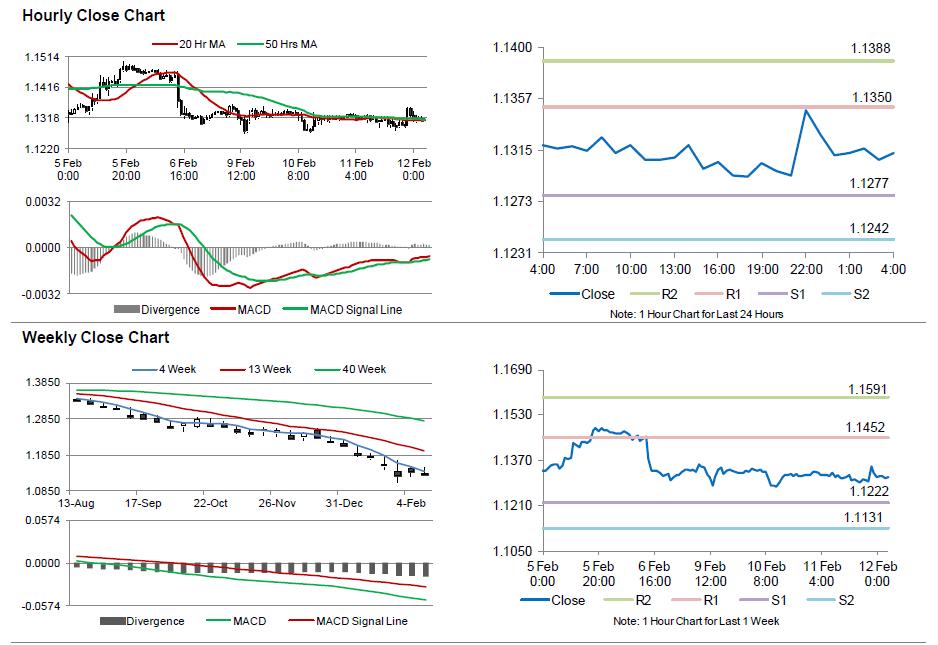

In the Asian session, at GMT0400, the pair is trading at 1.1312, with the EUR trading 0.13% lower from yesterday’s close.

The pair is expected to find support at 1.1277, and a fall through could take it to the next support level of 1.1242. The pair is expected to find its first resistance at 1.1350, and a rise through could take it to the next resistance level of 1.1388.

Trading trends in the Euro today are expected to be determined by Germany’s inflation data, scheduled in a few hours. Additionally, the US advance retail sales data coupled with initial jobless claims data, scheduled later today would grab a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.