On Friday, the EUR rose 0.14% against the USD and closed at 1.0983.

Meanwhile, market participants continue to closely monitor developments in the debt negotiations between Greece and its international creditors.

Data released showed that German retail sales rebounded more than expected by 1.70% MoM in April, compared to market expectations for a rise of 1.00%. In the prior month, it had fallen by a revised 1.40%, suggesting that private consumption will remain a growth driver for the Euro-zone’s biggest economy.

Elsewhere, in Italy, GDP expanded 0.3% in the January-March period, quarter-on-quarter, meeting estimates, while it rose 0.1% on a yearly basis.

The greenback came under pressure, after the second estimate of the nation’s annualized GDP shrank 0.7% in 1Q 2015, a significant downward revision from an initial estimate of 0.2% growth, thus indicating a disappointing start that could foil the chance of the US reaching 3% growth in 2015 for the first time in a decade.

In other economic news, the final Reuters/Michigan consumer sentiment index dropped to 90.70 in May, compared to market expectations of a fall to a level of 90.00.

In the Asian session, at GMT0300, the pair is trading at 1.0950, with the EUR trading 0.3% lower from Friday’s close.

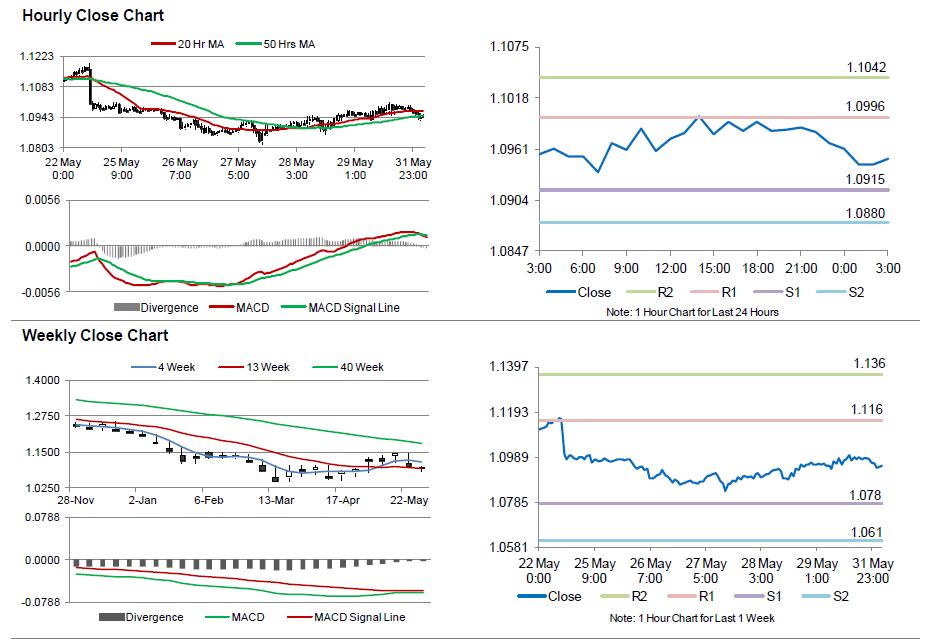

The pair is expected to find support at 1.0915, and a fall through could take it to the next support level of 1.0880. The pair is expected to find its first resistance at 1.0996, and a rise through could take it to the next resistance level of 1.1042.

Trading trends in the Euro today are expected to be determined by Germany’s CPI data, along with the manufacturing data from the Euro-zone and its peripheries, scheduled in a few hours. Additionally, the US ISM manufacturing PMI data, scheduled later today would be closely watched by market participants.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.