For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.1327, after a forward looking indicator in the Euro zone’s largest economy improved substantially in May, indicating that the European Central Bank’s (ECB) increased monetary stimulus package is finally starting to show results.

Data showed that Germany’s Gfk consumer confidence index surprisingly advanced to a level of 9.7 in May, its highest level since September 2015, compared to investor expectations for it to remain steady at a reading of 9.4.

The greenback lost ground, after the US Federal Reserve (Fed) kept interest rate steady at 0.5%. In a statement that largely mirrored the one issued after its last policy meeting in March, the Fed described an improving labour market but acknowledged that economic growth seemed to have slowed and insisted that it would continue to monitor inflation indicators and global economic and financial developments closely.

In other economic news, US pending home sales advanced above expectations to a one-year high level of 1.4% MoM in March, compared to market expectations for an advance of 0.5%. Pending home sales had recorded a revised rise of 3.4% in the prior month. On the other hand, the nation’s mortgage applications declined for the first time in four weeks by 4.1% in the week ended April 22, following a rise of 1.3% in the previous week.

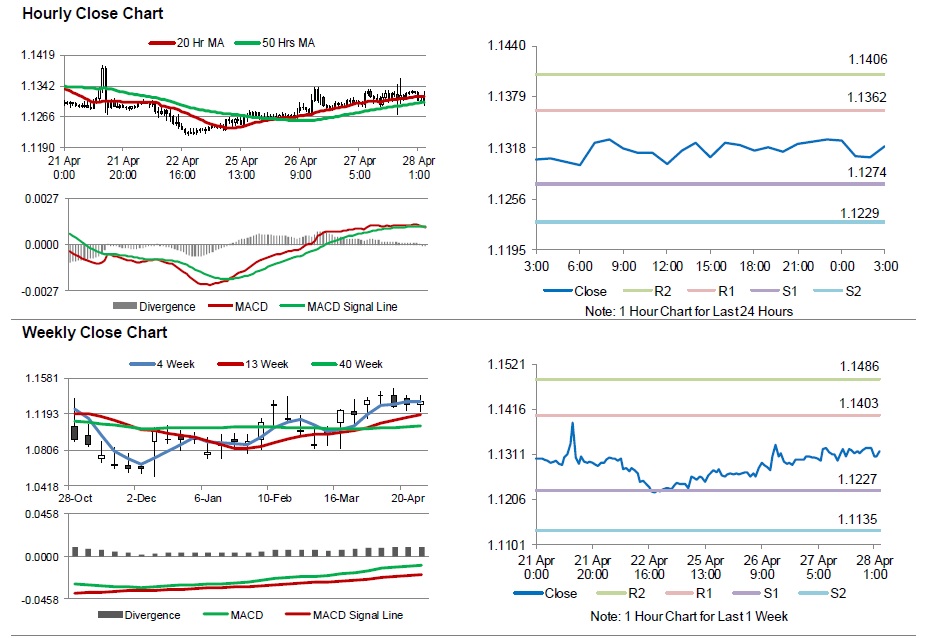

In the Asian session, at GMT0300, the pair is trading at 1.1319, with the EUR trading 0.07% lower from yesterday’s close.

The pair is expected to find support at 1.1274, and a fall through could take it to the next support level of 1.1229. The pair is expected to find its first resistance at 1.1362, and a rise through could take it to the next resistance level of 1.1406.

Going ahead, investors will look forward to Germany’s consumer price index data for April, scheduled to release later in the day. Moreover, the US initial jobless claims and 1Q GDP data, due later today, will also attract market attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.