For the 24 hours to 23:00 GMT, the EUR declined 0.77% against the USD and closed at 1.1310.

In economic news, Germany’s seasonally adjusted trade surplus unexpectedly rose to a record high level of €24.0 billion in April, from a level of €23.7 billion in the previous month. Meanwhile, imports surprisingly fell 0.2% and exports remained flat on a monthly basis in April.

Separately, the European Central Bank (ECB) President, Mario Draghi, underlined the importance of the Euro-zone government’s involvement to boost growth and inflation in the region. He further warned that the Euro-zone could not rely solely on the central bank’s efforts and that the lack of economic reforms is making the ECB’s job harder.

The greenback gained ground, after the US initial jobless claims surprisingly dropped to a level of 264.0K in the week ended 04 June 2016, compared to market expectations of a rise to a level of 270.0K. Initial jobless claims had registered a revised reading of 268.0K in the prior week. Additionally, the nation’s wholesale inventories advanced above expectations by 0.6% in April, from a 0.2% growth in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1293, with the EUR trading 0.15% lower against the USD from yesterday’s close.

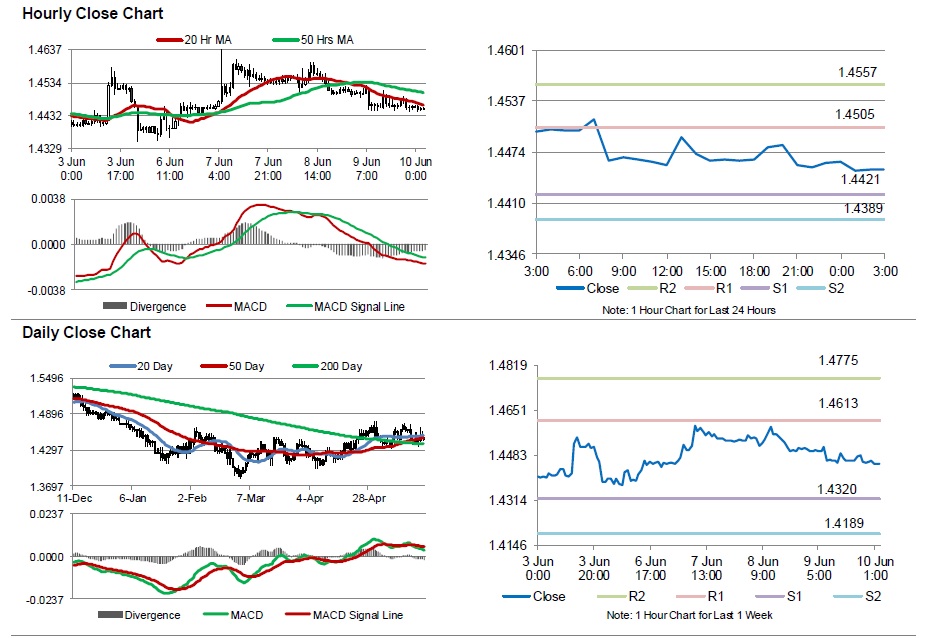

The pair is expected to find support at 1.1250, and a fall through could take it to the next support level of 1.1208. The pair is expected to find its first resistance at 1.1375, and a rise through could take it to the next resistance level of 1.1458.

Going ahead, investors will look forward to Germany’s consumer price index (CPI) data for May, scheduled to release in a few hours. Moreover, the US monthly budget statement for May and the preliminary Reuters/Michigan consumer sentiment index data for June, will also attract market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.