For the 24 hours to 23:00 GMT, the EUR rose 0.55% against the USD and closed at 1.1070.

In economic news, the Euro-zone’s import price index rose more-than-expected by 0.9% MoM in May, following a 0.1% drop in the previous month.

Separately, the European Central Bank President, Mario Draghi, indicated that the global economy would benefit from alignment of monetary policies by central banks around the world.

In the US, final annualised GDP for the first quarter was revised up to 1.1%, higher than market expectations for a rise of 1.0%. The preliminary figures had indicated a rise of 0.8%. In the prior quarter, the annualised GDP had recorded a rise of 1.4%. Additionally, the nation’s consumer confidence index advanced above expectations to a level of 98.0 in June, snapping a two-month losing streak and recording its highest level since October 2015. In the previous month, the index had registered a level of 92.4. Further, the S&P/Case-Shiller composite home price index (HPI) of 20 metropolitan areas recorded a rise of 5.44% YoY in April, compared to a revised advance of 5.48% in the previous month. On the other hand, the Richmond Fed manufacturing index surprisingly dropped to a level of -7.0 in June, following a reading of 1.0 in the previous month.

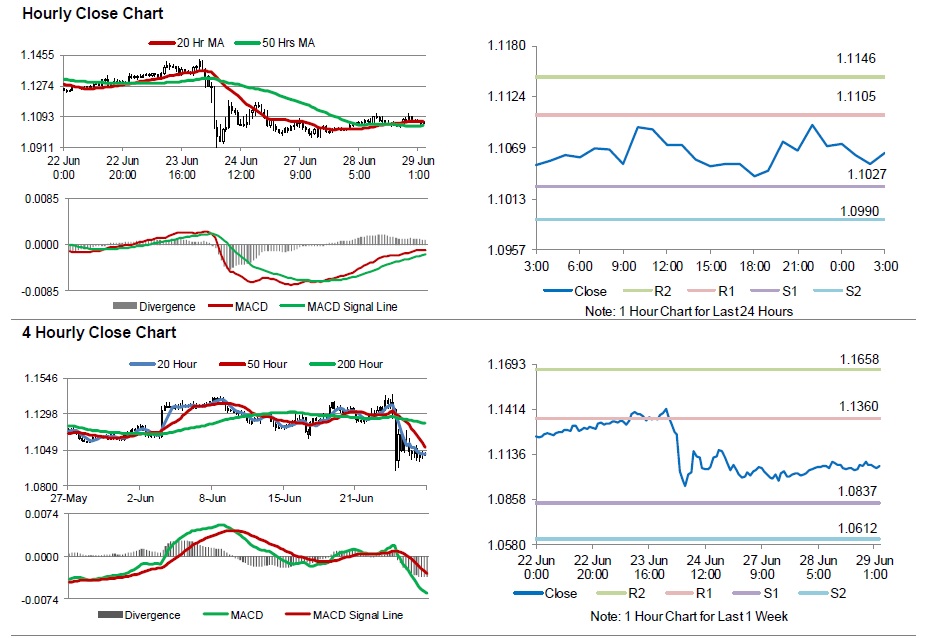

In the Asian session, at GMT0300, the pair is trading at 1.1063, with the EUR trading 0.06% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1027, and a fall through could take it to the next support level of 1.099. The pair is expected to find its first resistance at 1.1105, and a rise through could take it to the next resistance level of 1.1146.

Going ahead, investors look forward to Germany’s GfK consumer confidence and flash consumer price index (CPI) data along with the Euro zone’s consumer confidence index data, scheduled to release in a few hours. Moreover, the US weekly mortgage applications and pending home sales data, due later today, will attract market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.