For the 24 hours to 23:00 GMT, the EUR declined 0.77% against the USD and closed at 1.2638.

The US Dollar traded higher after the Fed at its monthly monetary policy meeting agreed to end its asset-buying program that had supported the US economic growth for the last 27 months. Additionally, it held its benchmark interest rates unchanged at 0.25% and pledged to keep its interest rates low for a “considerable time”. However, it stated that if the US economy improves faster than expected, then the first rate hike could come sooner than anticipated.

Elsewhere, in France, Euro-zone’s second biggest economy, consumer confidence remained steady at 85.0 in October, lower than market expectations to advance to 86.0. Meanwhile, retail sales in Spain grew 1.1% on an annual basis in September, beating market expectations for a rise of 0.6% and compared to an advance of 0.4% registered in August.

Separately, the ECB in its quarterly Bank Lending Survey revealed that the banks in the region had eased loan standards to the private sector in the third quarter.

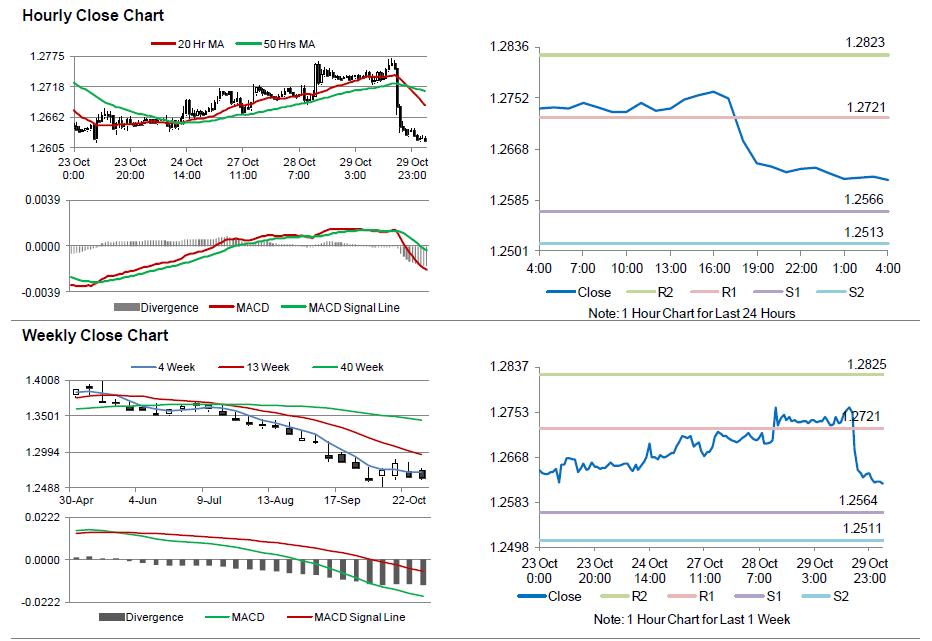

In the Asian session, at GMT0400, the pair is trading at 1.2618, with the EUR trading 0.16% lower from yesterday’s close.

The pair is expected to find support at 1.2566, and a fall through could take it to the next support level of 1.2513. The pair is expected to find its first resistance at 1.2721, and a rise through could take it to the next resistance level of 1.2823.

Trading trends in the Euro today are expected to be determined by Germany’s crucial CPI data, scheduled in a few hours. Meanwhile, the US GDP and initial jobless claims data would keep market participants on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.