For the 24 hours to 23:00 GMT, the EUR rose 1.19% against the USD and closed at 1.1371.

The greenback traded on a weaker footing, after durable goods orders unexpectedly tumbled 3.4% in December, registering its worst drop since August, while markets had predicted a 0.3% increase and compared to a 2.1% drop in November.

Losses were kept in check, after the US consumer confidence surged to its highest level since August 2007 to 102.9 in January, beating market expectations for a jump to a reading of 95.5 and compared to a revised advance of 93.3 recorded in December, thereby indicating that the US consumers are upbeat about the nation’s economy at the start of 2015. Meanwhile, the nation’s preliminary services PMI advanced to 54.0 in January, compared to market expectations of a rise to 53.8. In the prior month, services PMI had registered a level of 53.30.

In other economic news, new home sales rebounded more than expected by 11.6% on a MoM basis in December, against market expectations for a 2.7% rise. It had eased 6.7% in the prior month. Meanwhile, the US Richmond composite index of manufacturing fell to a level of 6.0 in January, meeting market expectations.

In the Asian session, at GMT0400, the pair is trading at 1.1342, with the EUR trading 0.25% lower from yesterday’s close.

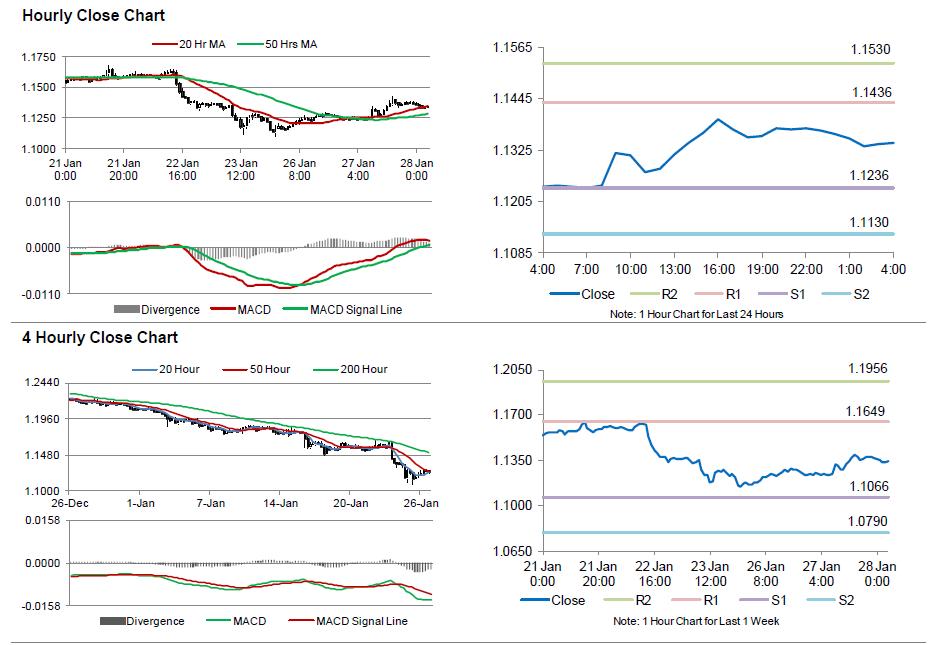

The pair is expected to find support at 1.1236, and a fall through could take it to the next support level of 1.1130. The pair is expected to find its first resistance at 1.1436, and a rise through could take it to the next resistance level of 1.1530.

Trading trends in the Euro today are expected to be determined by Germany’s Gfk consumer confidence data, scheduled in few hours. Additionally, market participants, would keep a tab on the Fed’s policy meeting scheduled later today, where the post meeting statement will be keenly scrutinised to gauge the timing of an interest rate rise in the nation.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.