For the 24 hours to 23:00 GMT, the EUR declined 0.87% against the USD and closed at 1.0884, as ongoing concerns about a possible Greek default with its international creditors weighed on the common-currency.

In the US, the consumer confidence index increased more than expected to a level of 95.4, indicating that the US consumers turned little more optimistic about the economy in May. The index had registered a revised reading of 94.3 in April. On the other hand, orders for US durable goods fell 0.5% in April, reversing from previous month’s revised gain of 5.1%.

In other economic news, the preliminary estimate of US services PMI slipped to a reading of 56.4, registering its lowest level since January in May and compared to prior month’s 57.4 mark. Meanwhile, new homes sales rebounded 6.8% MoM in April, beating market expectations for a 5.0% rise and following a revised 10.0% drop recorded in the previous month. Also, the Dallas Fed manufacturing business index unexpectedly dropped to a level of -20.80 in May, compared to market expectations of a rise to a level of -11.50.

In the Asian session, at GMT0300, the pair is trading at 1.0878, with the EUR trading 0.06% lower from yesterday’s close.

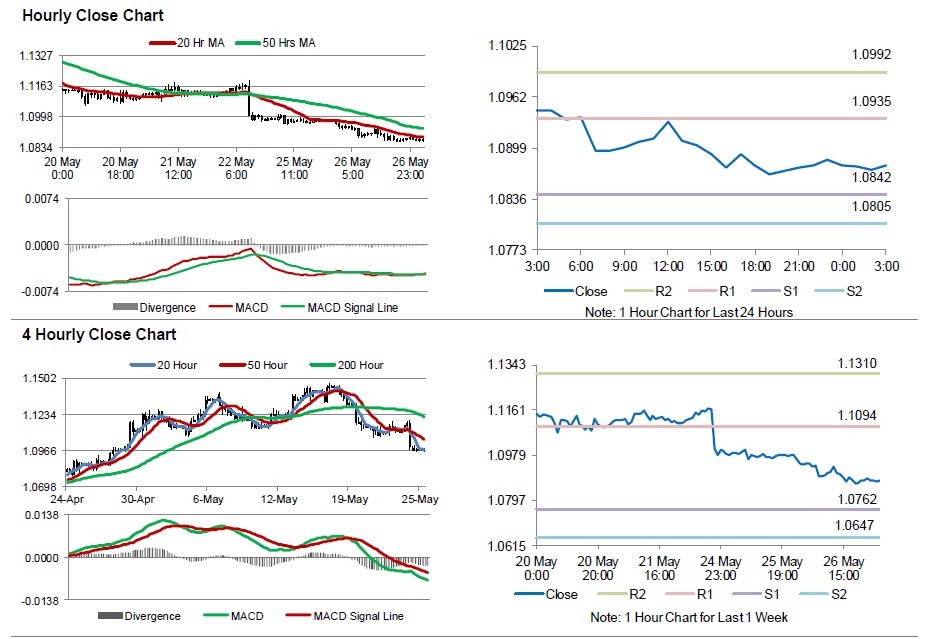

The pair is expected to find support at 1.0842, and a fall through could take it to the next support level of 1.0805. The pair is expected to find its first resistance at 1.0935, and a rise through could take it to the next resistance level of 1.0992.

Trading trends in the pair today are expected to be determined by Germany’s Gfk consumer confidence survey data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.