For the 24 hours to 23:00 GMT, the EUR declined 0.31% against the USD and closed at 1.1215.

In economic news, data indicated that Germany’s import price index fell by 0.2% on a monthly basis in August, more than market expectations for a fall of 0.1% and following a gain of 0.1% in the prior month.

Macroeconomic data released in the US indicated that the US consumer confidence unexpectedly jumped to a nine-years high level of 104.1 in September, bolstering optimism over the health of the world’s largest economy. Markets expected the index to drop to a level of 99.0, compared to a revised level of 101.8 in the previous month. Additionally, the nation’s flash Markit services PMI advanced to a level of 51.9 in September, expanding at the fastest pace since April 2016, from a level of 51.0 in the prior month and beating investor consensus for a rise to a level of 51.2. Meanwhile, the nation’s Richmond Fed manufacturing index improved less-than-expected to a level of -8.0, following a level of -11.0 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1202, with the EUR trading 0.12% lower against the USD from yesterday’s close.

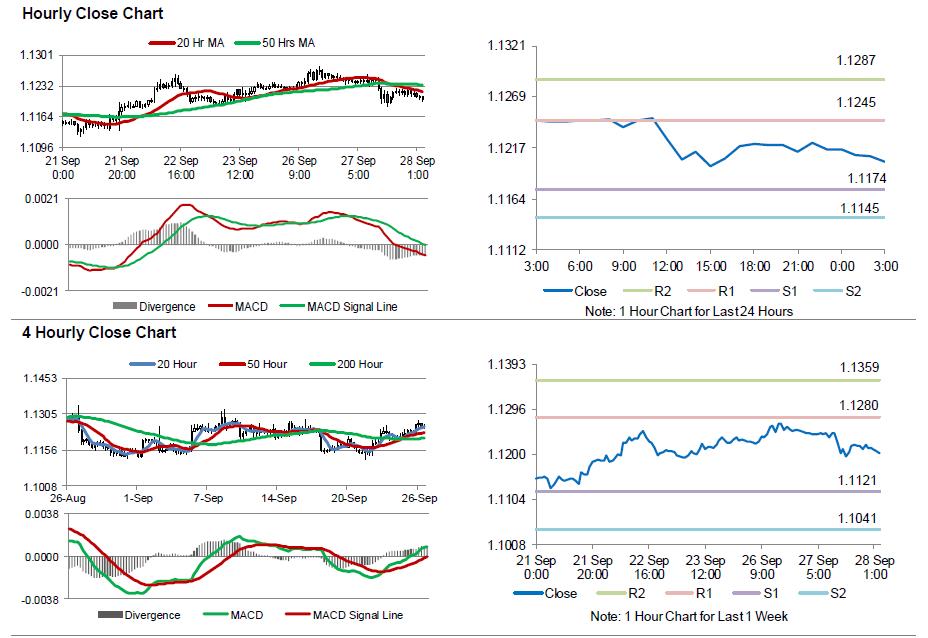

The pair is expected to find support at 1.1174, and a fall through could take it to the next support level of 1.1145. The pair is expected to find its first resistance at 1.1245, and a rise through could take it to the next resistance level of 1.1287.

Looking ahead, market participants would closely monitor Germany’s GfK consumer confidence survey data for October, scheduled to release in some time. Moreover, investors would also keenly watch the Fed Chair, Janet Yellen’s speech before House Panel along with the nation’s flash durable goods orders for August and MBA mortgage applications data, due later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.