For the 24 hours to 23:00 GMT, the EUR declined 0.35% against the USD and closed at 1.2290.

Yesterday, data showed that the Ifo business expectations index in Germany climbed for the second straight month to 101.1 in December, higher than market expectations of a rise to 100.5. In the previous month, the Ifo business expectations index had registered a revised reading of 99.80. Additionally, the nation’s Ifo business climate index advanced to 105.5 in December, in line with market expectations, thus showing that the region’s biggest economy was overcoming the weakness that hit it earlier in the year.

Other economic data indicated that the seasonally adjusted construction output in the Euro-zone rebounded 1.3% on a MoM basis in October, compared to a revised drop of 1.0% recorded in the prior month.

Elsewhere, in Italy, current account surplus rose to €5.46 billion in October. The country had registered a current account surplus of €0.64 billion in the previous month.

The greenback traded on a stronger footing after number of people claiming initial jobless claims in the US eased unexpectedly to a level of 289.0 K, in the week ended 13 December 2014 and following a revised reading of 295.0 K in the prior week. Additionally, continuing claims dropped more than expected to 2373.00 K in the week ended 6 December 2014, against market expectations claims to decrease to a level of 2435.0 K. Meanwhile, the CB leading indicator in the nation registered a rise of 0.6% in November, exceeding market expectations for a rise of 0.5%.

Gains in the greenback were kept in check, after the US Markit services PMI unexpectedly hit a 10-month low of 53.6 in December, lower than market expectations to climb to a level of 56.3 and compared to previous month’s level of 56.2. Additionally, the diffusion index of current activity slumped to a level of 24.5 in December, compared to a level of 40.8 in the prior month. Markets were expecting the index ease to a level of 26.0.

In the Asian session, at GMT0400, the pair is trading at 1.2277, with the EUR trading 0.1% lower from yesterday’s close.

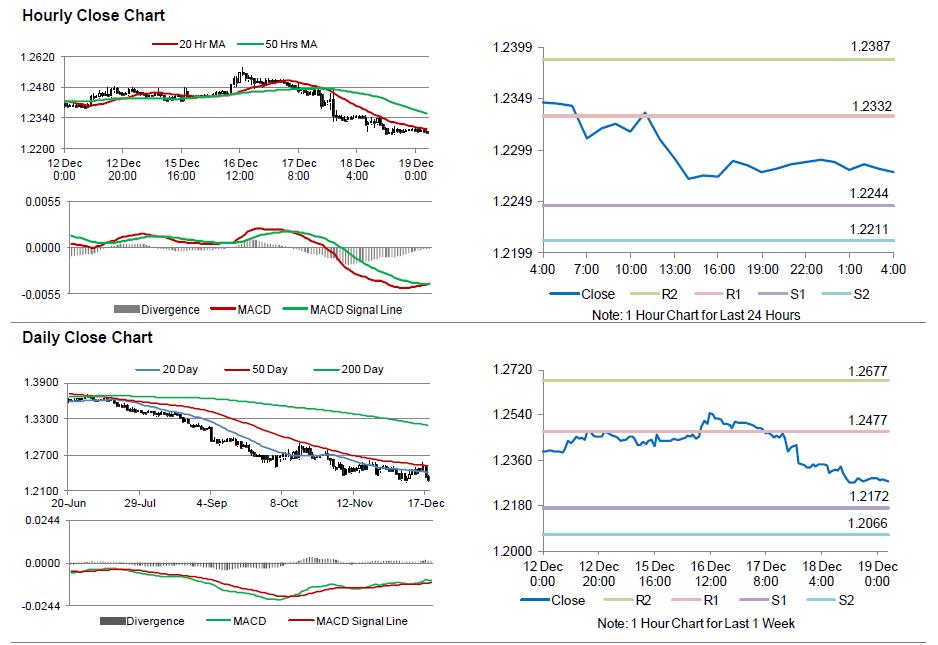

The pair is expected to find support at 1.2244, and a fall through could take it to the next support level of 1.2211. The pair is expected to find its first resistance at 1.2332, and a rise through could take it to the next resistance level of 1.2387.

Trading trends in the Euro today are expected to be determined by Germany’s GfK consumer confidence survey data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.