For the 24 hours to 23:00 GMT, the EUR rose 0.37% against the USD and closed at 1.1373.

In economic news, the Euro-zone’s flash manufacturing PMI surprisingly rose to a level of 52.6 in June, from a reading of 51.5 in the previous month. On the other hand, the region’s service PMI declined more-than-expected to a level of 52.4 in June, compared to a reading of 53.3 in the previous month. Meanwhile in Germany, the preliminary manufacturing PMI advanced to a level of 54.4 in June, compared to a reading of 52.1 in the previous month. Markets were anticipating manufacturing PMI to ease to a level of 52.0. In contrast, the nation’s services PMI fell more-than-expected to a level of 53.3 in June, from a reading of 55.2 in the previous month.

In the US, new home sales fell 6.0% MoM in May to a level of 551.0K. Market anticipation was for new home sales to drop to 560.0K, compared to a revised reading of 586.0K in the previous month. Moreover, the Chicago Fed national activity index eased unexpectedly to -0.51 in the US, compared to market expectations of a rise to a level of 0.11. The index had registered a revised level of 0.05 in the previous month. On the other hand, US initial jobless claims fell to a level of 259.0K for the week ended 18 June 2016, the lowest leave since April this year and compared to a level of 277.0K in the prior week. Additionally, flash Markit manufacturing PMI rose above expectations to a level of 51.4 in June, from a reading of 50.7 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1030, with the EUR trading 3.02% lower against the USD from yesterday’s close.

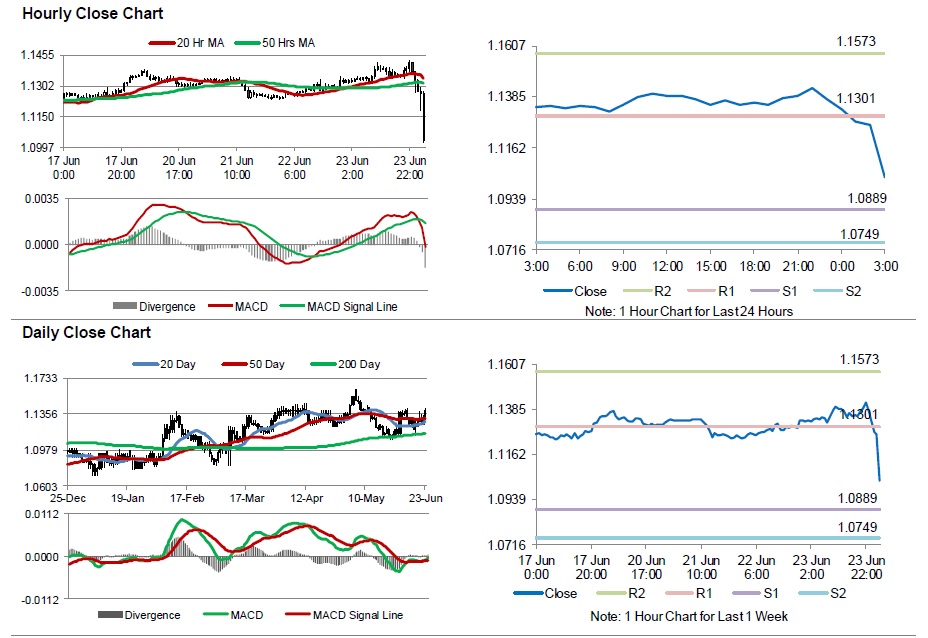

The pair is expected to find support at 1.0889, and a fall through could take it to the next support level of 1.0749. The pair is expected to find its first resistance at 1.1301, and a rise through could take it to the next resistance level of 1.1573.

Going ahead, investors look forward to Germany’s IFO survey data for June, scheduled to release in a few hours. Moreover, the US durable goods orders, due later today, will also attract market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.