For the 24 hours to 23:00 GMT, the EUR rose 1.12% against the USD and closed at 1.2652.

On the macro front, the Sentix consumer confidence in the Euro-zone eased for the third consecutive month in October to -13.7, registering its lowest level since May 2013 and compared to a level of -9.8 recorded in the previous month. Markets were expecting it to fall to a level of -11.0. Additionally, factory orders in Germany declined 5.7%, on a monthly basis, in August, falling at its fastest rate since 2009, higher than market expectations for a drop of 2.5% and following a revised advance of 4.9% registered in the prior month, thereby highlighting risk of a slowdown in the Euro-zone’s biggest economy. Meanwhile, the nation’s construction PMI recorded a level of 50.0 in September, after registering a reading of 47.7 in August.

In the US, the Kansas City Fed President, Esther George, opined that the central bank needs to raise its short-term interest rates as she sees improvement in the US economy.

In the Asian session, at GMT0300, the pair is trading at 1.2611, with the EUR trading 0.32% lower from yesterday’s close.

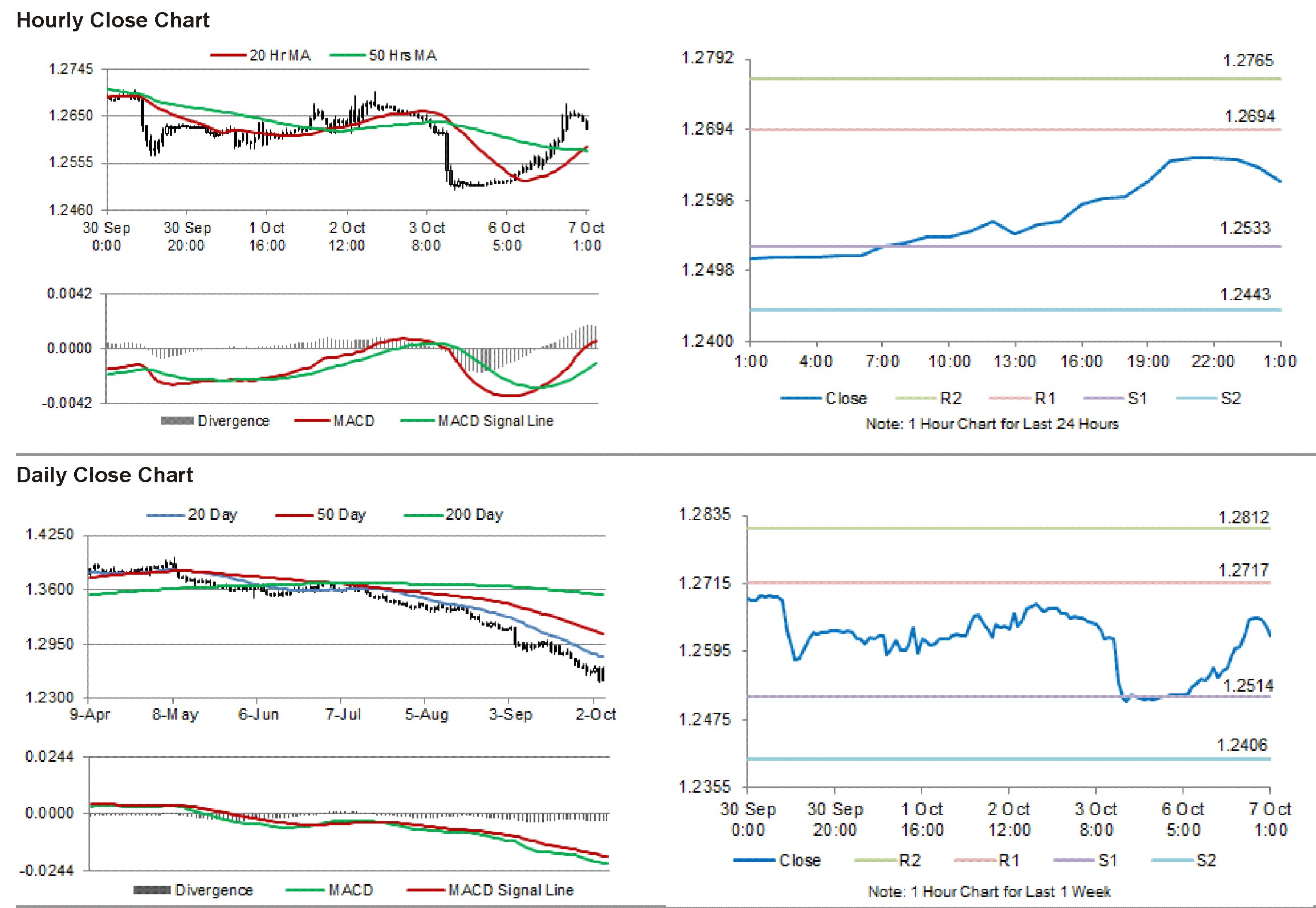

The pair is expected to find support at 1.2525, and a fall through could take it to the next support level of 1.2439. The pair is expected to find its first resistance at 1.2686, and a rise through could take it to the next resistance level of 1.2761.

Trading trends in the Euro today are expected to be determined by Germany’s industrial production data, set for release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.