For the 24 hours to 23:00 GMT, the EUR rose 0.52% against the USD and closed at 1.2438, following encouraging IFO economic data from Germany.

Yesterday, data indicated that Germany’s IFO business climate index surprisingly rose to a level of 104.7 in November, posting its first gain since April, and higher than market expectations of a fall to 103.0 and following a reading of 103.2 recorded in October. Additionally, the nation’s IFO business expectations index unexpectedly advanced to a level of 99.7 in November, compared to a reading of 98.3 registered in the prior month, while markets were expecting the index to ease to a level of 95.5, thus highlighting positive signs for the economic outlook of the Euro-zone’s biggest economy. Meanwhile, Germany’s IFO current assessment index increased to 110.0 in November, exceeding market expectations of a fall to a level of 108.0.

Elsewhere, in Italy, the non-EU trade balance surplus widened to €4.04 billion in October, compared to a trade surplus of €1.53 billion registered in the previous month.

Separately, the ECB’s Governing Council Member, Jens Weidmann urged member nations’ government to implement structural reform, arguing that the central bank’s loose monetary policies “can influence short-term demand” but “it cannot permanently boost growth prospect”.

The greenback lost ground after the US services PMI data surprisingly tumbled to a 7-month low level of 56.3 in November, lower than market expectations for a rise to a reading of 57.3 and down from previous month’s mark of 57.1. Additionally, the Chicago Fed national activity index surprisingly eased to 0.14 in October, compared to market expectations of a rise to 0.40. On the other hand, the Dallas Fed manufacturing business index remained flat at a level of 10.5 in November, higher than market expectations of a drop to 9.00.

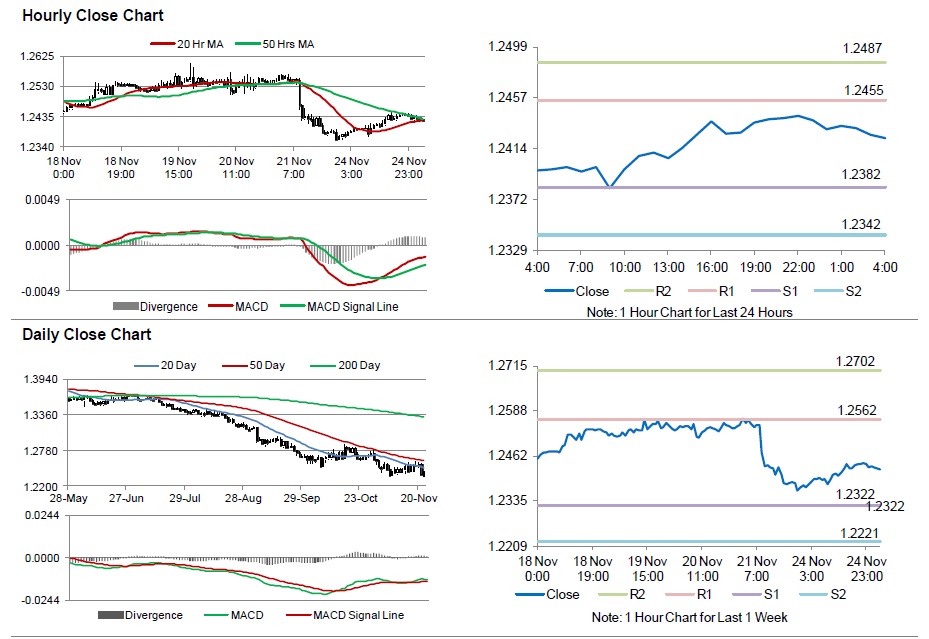

In the Asian session, at GMT0400, the pair is trading at 1.2423, with the EUR trading 0.12% lower from yesterday’s close.

The pair is expected to find support at 1.2382, and a fall through could take it to the next support level of 1.2342. The pair is expected to find its first resistance at 1.2455, and a rise through could take it to the next resistance level of 1.2487.

Trading trends in the Euro today are expected to be determined by Germany’s crucial Q3 GDP data, set for release in a few hours. Meanwhile, the US Q3 GDP coupled with consumer confidence data, scheduled later today would grab a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.