For the 24 hours to 23:00 GMT, the EUR rose 0.60% against the USD and closed at 1.0968, as forex traders continuously monitored high-level discussions in Brussels regarding the Greek debt crisis.

In the US, number of people filing for initial jobless claims advanced unexpectedly to 282.00 K in the week ended 23 May 2015, compared to a revised reading of 275.00 K in the previous week, while markets were expecting initial jobless claims to ease to 270.00K.

Other economic data indicated that pending home sales in the US climbed to nine-year high level as it gained 3.40% MoM in April, beating market expectations for a rise of 0.80%.

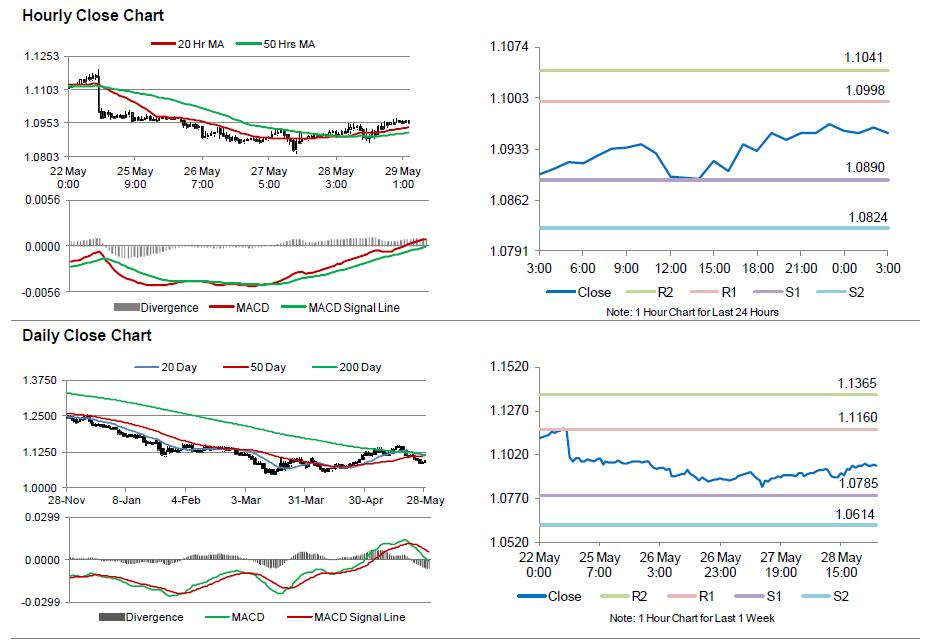

In the Asian session, at GMT0300, the pair is trading at 1.0956, with the EUR trading 0.11% lower from yesterday’s close.

Separately, the Minneapolis Fed President, Narayana Kocherlakota opined that it would be a mistake to raise interest rates this year. Further, he stated that the Fed should be ‘extra ordinarily’ patient in tightening monetary policy and should hold off raising rates this year to enable the labour market to show further improvement.

The pair is expected to find support at 1.0890, and a fall through could take it to the next support level of 1.0824. The pair is expected to find its first resistance at 1.0998, and a rise through could take it to the next resistance level of 1.1041.

Trading trends in the Euro today are expected to be determined by Germany’s retail sales data, scheduled in a few hours. Additionally, the US economy will be in focus with key releases including the first quarter GDP and the Reuters/Michigan consumer sentiment index, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.