For the 24 hours to 23:00 GMT, the EUR declined 0.19% against the USD and closed at 1.1374, after the ECB Chief, Mario Draghi, stated that the Euro-zone is prone to challenges from global economic shocks and is unclear over the region’s ability to cope with it. He also mentioned that the central bank will do “whatever is needed” to push up inflation from its dangerously low levels.

Separately, according to minutes of the ECB’s March monetary policy meeting, policymakers discussed the possibility of a sharper interest rate cut in March, but decided that a smaller one was appropriate, given the current economic assessment. The minutes also revealed that the central bank did not rule out the possibility of further rate cuts.

In the US, the Federal Reserve Chair, Janet Yellen, expressed confidence in the US economy, indicating that the nation’s labour market was now “close” to full strength and that inflation is expected to tick higher.

In other economic news, US initial jobless claims fell to a level of 267.0K, compared to market expectations of a drop to 270.0K. In the prior week, initial jobless claims had recorded a reading of 276.0K. On the other hand, the nation’s consumer credit rose more-than-expected to a level of $17.2 billion in February, compared to market expectations for an advance of $14.9 billion. In the previous month, consumer credit had advanced by a revised $10.5 billion

In the Asian session, at GMT0300, the pair is trading at 1.1364, with the EUR trading 0.09% lower from yesterday’s close.

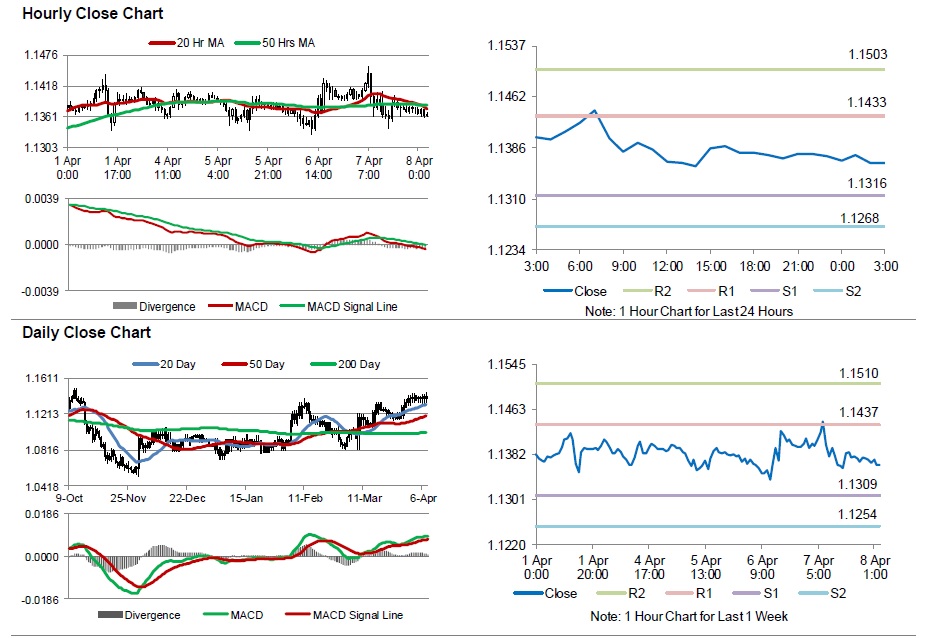

The pair is expected to find support at 1.1316, and a fall through could take it to the next support level of 1.1268. The pair is expected to find its first resistance at 1.1433, and a rise through could take it to the next resistance level of 1.1503.

Going ahead, investors will look forward to Germany’s trade balance data for February, scheduled to release in a few hours. Additionally, the US wholesale inventories data for February, due later in the day, will also attract market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.