On Friday, the EUR declined 1.58% against the USD and closed at 1.0855.

In economic news, the Euro-zone’s economy grew 0.3% QoQ in the final quarter of 2014, in line with market expectations and compared to a growth of 0.2% registered in the previous quarter. Separately, industrial production in Germany advanced 0.6% on a monthly basis in January, beating market expectations for an increase of 0.5%. In the prior month, the nation’s industrial production had climbed by a revised 1.0%.

The greenback traded on a stronger footing after the unemployment rate eased more than expected to 5.5%, posting its lowest level since May 2008 in February and compared to market expectations of a drop to a reading of 5.6%. The nation’s unemployment rate in the prior month came in at 5.7%. Additionally, the US non-farm payrolls climbed by 295.00 K in February, higher than market expectations of an advance of 235.00 K. It had recorded a revised gain of 239.00 K in the prior month.

Other economic data showed that the US trade deficit narrowed less than expected to $41.8 billion in January, following a revised deficit of $45.6 billion registered in the prior month. Meanwhile, consumer credit rose $11.56 billion in January, less than market forecasts for an advance of $14.75 billion and down from previous month’s level of $17.87 billion.

In the Asian session, at GMT0400, the pair is trading at 1.0841, with the EUR trading 0.13% lower from Friday’s close.

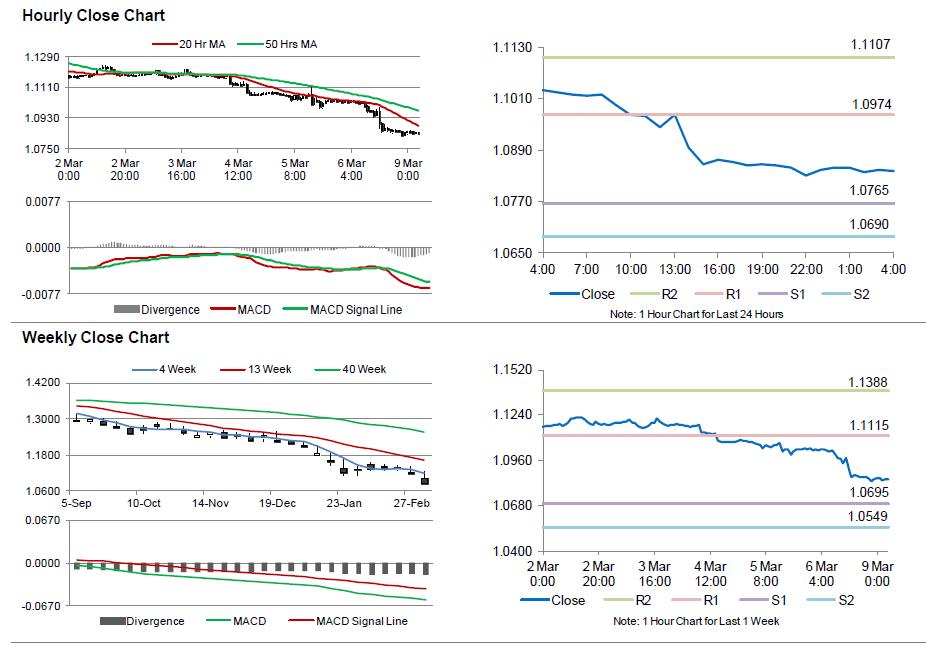

The pair is expected to find support at 1.0765, and a fall through could take it to the next support level of 1.0690. The pair is expected to find its first resistance at 1.0974, and a rise through could take it to the next resistance level of 1.1107.

Trading trends in the Euro today are expected to be determined by Germany’s trade balance coupled with the Euro-zone’s Sentix investor confidence data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.