For the 24 hours to 23:00 GMT, the EUR rose 0.38% against the USD and closed at 1.1606.

On the macro front, the Euro-zone’s seasonally adjusted current account surplus narrowed to €18.1 billion in November. The region had registered a revised current account surplus of €19.5 billion in October. Meanwhile, construction output in the single-currency region slid 0.1% on a monthly basis in November, following a revised 1.1% rise recorded in prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1579, with the EUR trading 0.23% lower from yesterday’s close.

Early this morning, the IMF cut its global growth forecast for 2015-2016 as it projected that the world economy would expand by 3.5% in 2015 and 3.7% next year, down from its earlier estimation of 3.8% and 4% growth, respectively. Additionally, the fund slashed the economic growth outlook for the Euro-zone to 1.2% in 2015, as compared to its previous forecast of 1.3%. Furthermore, the growth forecasts for the US was revised up to 3.6% from its previous forecast of 3.1%, citing more robust private domestic demand.

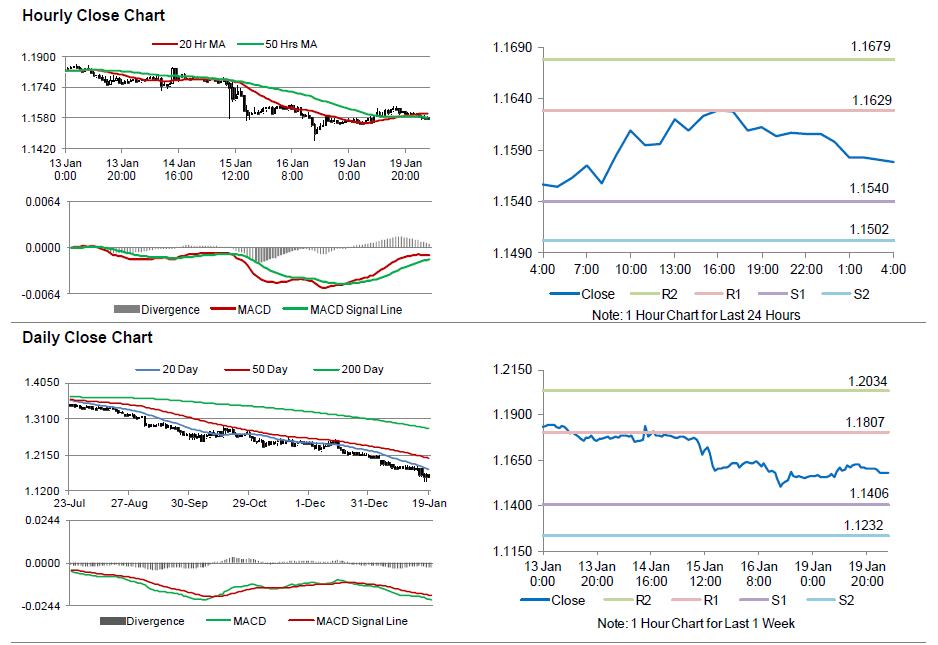

The pair is expected to find support at 1.1540, and a fall through could take it to the next support level of 1.1502. The pair is expected to find its first resistance at 1.1629, and a rise through could take it to the next resistance level of 1.1679.

Trading trends in the Euro today are expected to be determined by Germany’s ZEW economic survey data, scheduled in few hours.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.