For the 24 hours to 23:00 GMT, the EUR declined 0.50% against the USD and closed at 1.0737, on the back of downbeat construction output data in the Euro-zone.

Data showed that the seasonally adjusted construction output in the single-currency region fell for the first time in 3-months, dropping 1.8% MoM in February, compared to a revised rise of 1.6% recorded in the previous month.

Other economic data showed that Germany’s Producer price index rose 0.1% on a monthly basis in March, lower than market expected advance of 0.2%. It had risen 0.1% in the previous month.

In the US, the Chicago Fed national activity index unexpectedly dropped to a level of -0.42 in March, lower than market expectations of an advance to a level of 0.10. The index had recorded a revised level of -0.18 in the previous month.

Separately, the New York Fed President, William Dudley mentioned that he hopes the recent weakness in US economy to be temporary and hinted that going forward the macro performance of the nation would determine the timing of an interest rate rise in the nation.

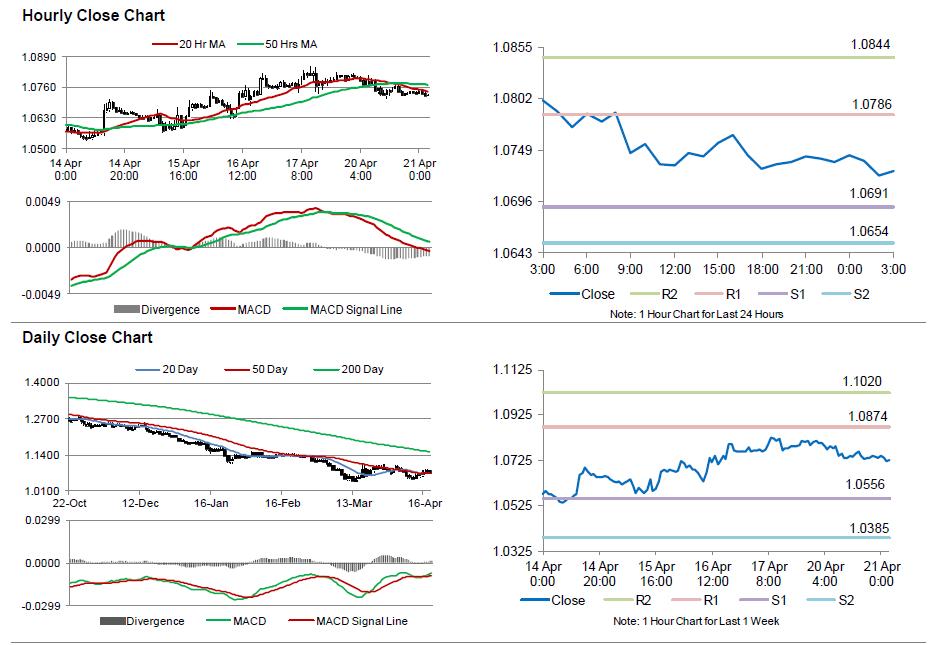

In the Asian session, at GMT0300, the pair is trading at 1.0728, with the EUR trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.0691, and a fall through could take it to the next support level of 1.0654. The pair is expected to find its first resistance at 1.0786, and a rise through could take it to the next resistance level of 1.0844.

Trading trends in the Euro today are expected to be determined by Germany’s ZEW economic sentiment data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.