For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.1130.

In economic news, the Euro-zone’s final consumer price index (CPI) dropped in line with market expectations by 0.1% YoY in May, compared to a fall of 0.2% in the previous month. Further, the region’s unemployment rate held steady at 10.2% in April, the lowest level since August 2011.

Elsewhere in Germany, retail sales unexpectedly declined 0.9% MoM in April, compared to market expectations for a rise of 0.9%. In the previous month, retail sales had dropped by a revised 1.4%. On the other hand, the nation’s seasonally adjusted unemployment rate surprisingly fell to a record low level of 6.1% in May, from a reading of 6.2% in the previous month.

In the US, consumer confidence index unexpectedly dropped to a level of 92.60 in May, lower than market expectations of an advance to 96.10. In the previous month, the CB consumer confidence index had recorded a revised reading of 94.70. Moreover, the nation’s Chicago Fed purchasing managers index fell to a level of 49.3 in May, lower than market expectations of a rise to 50.5 and after registering a reading of 50.4 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1122, with the EUR trading 0.07% lower from yesterday’s close.

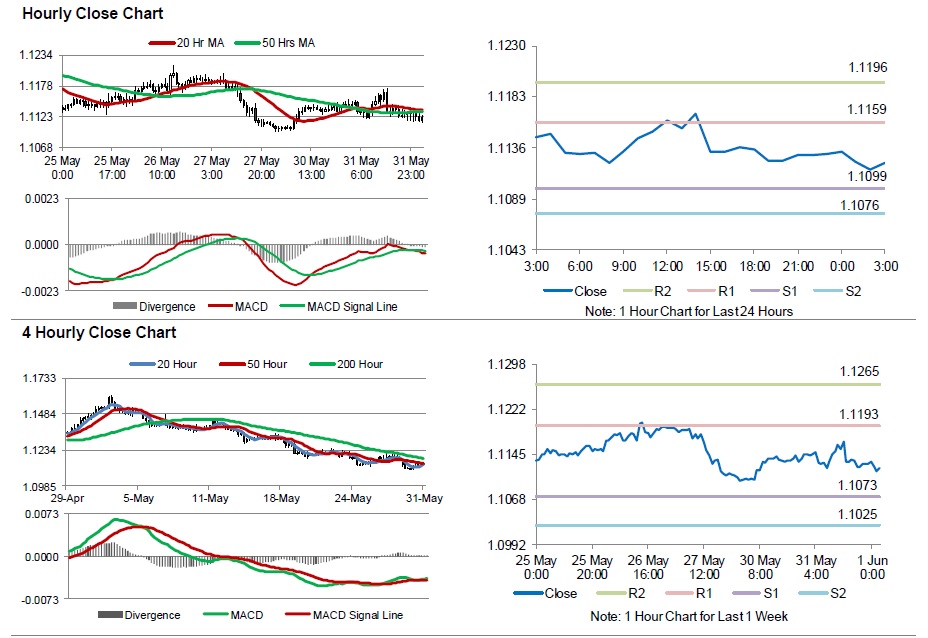

The pair is expected to find support at 1.1099, and a fall through could take it to the next support level of 1.1076. The pair is expected to find its first resistance at 1.1159, and a rise through could take it to the next resistance level of 1.1196.

Going ahead, investors will look forward to the Markit Manufacturing PMI data for May, across the Euro-zone, scheduled to release in a few hours. Additionally, the US Markit Manufacturing PMI for May and the Fed’s Beige Book report, due later today, will also grab market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.