For the 24 hours to 23:00 GMT, the EUR declined 0.15% against the USD and closed at 1.0608, after the Euro-zone’s preliminary annual consumer price inflation rose less-than-expected in November from October.

Data showed that the Euro-zone’s flash annual CPI advanced 0.1% in November, against market expectations for a 0.2% increase, and after recording a 0.1% growth in the previous month, thus strengthening the case for ECB to boost its stimulus programme.

The greenback gained ground after the Federal Reserve Chairperson, Janet Yellen, indicated a readiness to hike interest rates this month and as data pointed to a robust US labour market.

The Fed Chair, Janet Yellen, delivered a speech which seemed to indicate that the US central bank is prepared to raise interest rates this month at its December monetary policy meeting. She stated that since the Fed’s October meeting, the economic and financial information received has been consistent with its expectations of continued improvement in the US labour market and also noted that the Fed policymakers were now confident in the return of inflation to 2.0% as the effects of low energy and import prices fade.

Separately, the Fed, in its Beige Book which covers activity from mid-October through 20 November, indicated that economic activity in most regions of the country increased at a modest pace since the previous report. The publication also noted an improvement in the nation’s housing market and commercial construction, increased hiring and energy activity fell due to persistently low oil prices.

In other economic news, the US ADP private sector employment jumped by 217.0K jobs in November after climbing by an upwardly revised 196.0K jobs in the previous month. Investors had expected an increase of 190.0K. On the other hand, the nation’s MBA mortgage applications fell 0.2% in the week ended 27 November, after declining by 3.2% in the previous week.

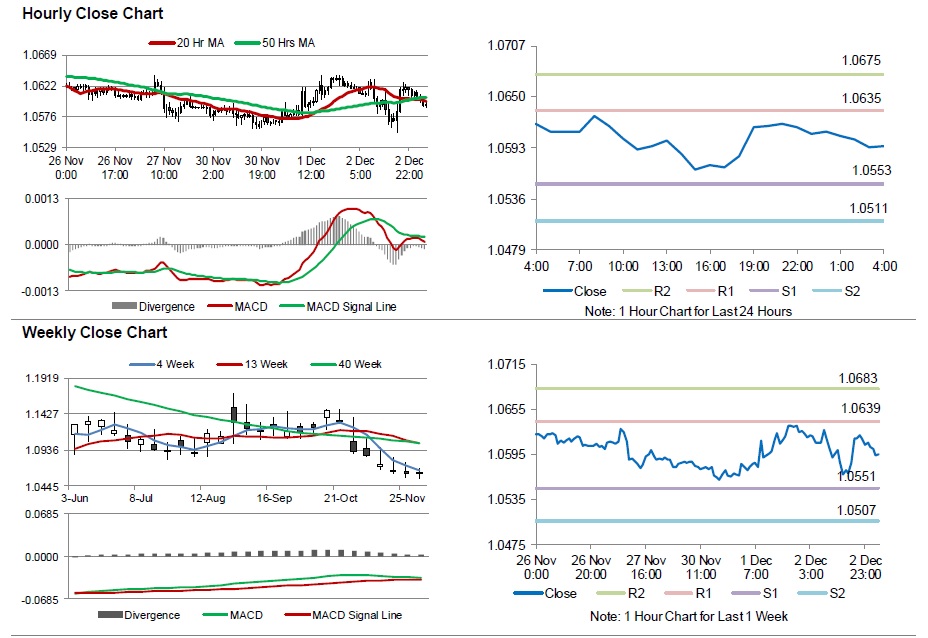

In the Asian session, at GMT0400, the pair is trading at 1.0595, with the EUR trading 0.13% lower from yesterday’s close.

The pair is expected to find support at 1.0553, and a fall through could take it to the next support level of 1.0511. The pair is expected to find its first resistance at 1.0635, and a rise through could take it to the next resistance level of 1.0675.

Moving ahead, investors will look forward to the Markit services PMI data for November across the Euro-zone, scheduled to be released in a few hours. Moreover, the US initial jobless claims and Markit services PMI data, due later in the day, will also grab a significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.