For the 24 hours to 23:00 GMT, the EUR declined 0.47% against the USD and closed at 1.3258. The US Dollar gained ground after the US Fed, in the minutes of its latest policy meeting, highlighted the improvements in the nation’s economy.

In economic news, the PPI in Germany unexpectedly decreased 0.1% in July, on monthly basis, compared with a flat reading in June. The Euro-zone construction output declined for the second successive month in June, falling 0.7%, on a monthly basis. It had dropped by a revised 1.4% in the prior month.

Separately, the German Chancellor, Angela Merkel, urged the Euro-zone leaders to come forward and coordinate more closely and repair the “construction flaws” to overcome the debt crisis in the Euro-zone.

In the US, the FOMC minutes indicated that committee members noted the improvement in the labour market and inflation in the nation moving closer to its longer term objective. While the minutes indicated that interest rates would continue to remain at low levels for a considerable period of time after the asset purchases end, the future course of interest rates would be dependent on how inflation and labour market conditions evolve. In economic data, the number of mortgage applications for the week ended August 15 rose 1.4%, compared to a fall of 2.7% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.3247, with the EUR trading 0.08% lower from yesterday’s close.

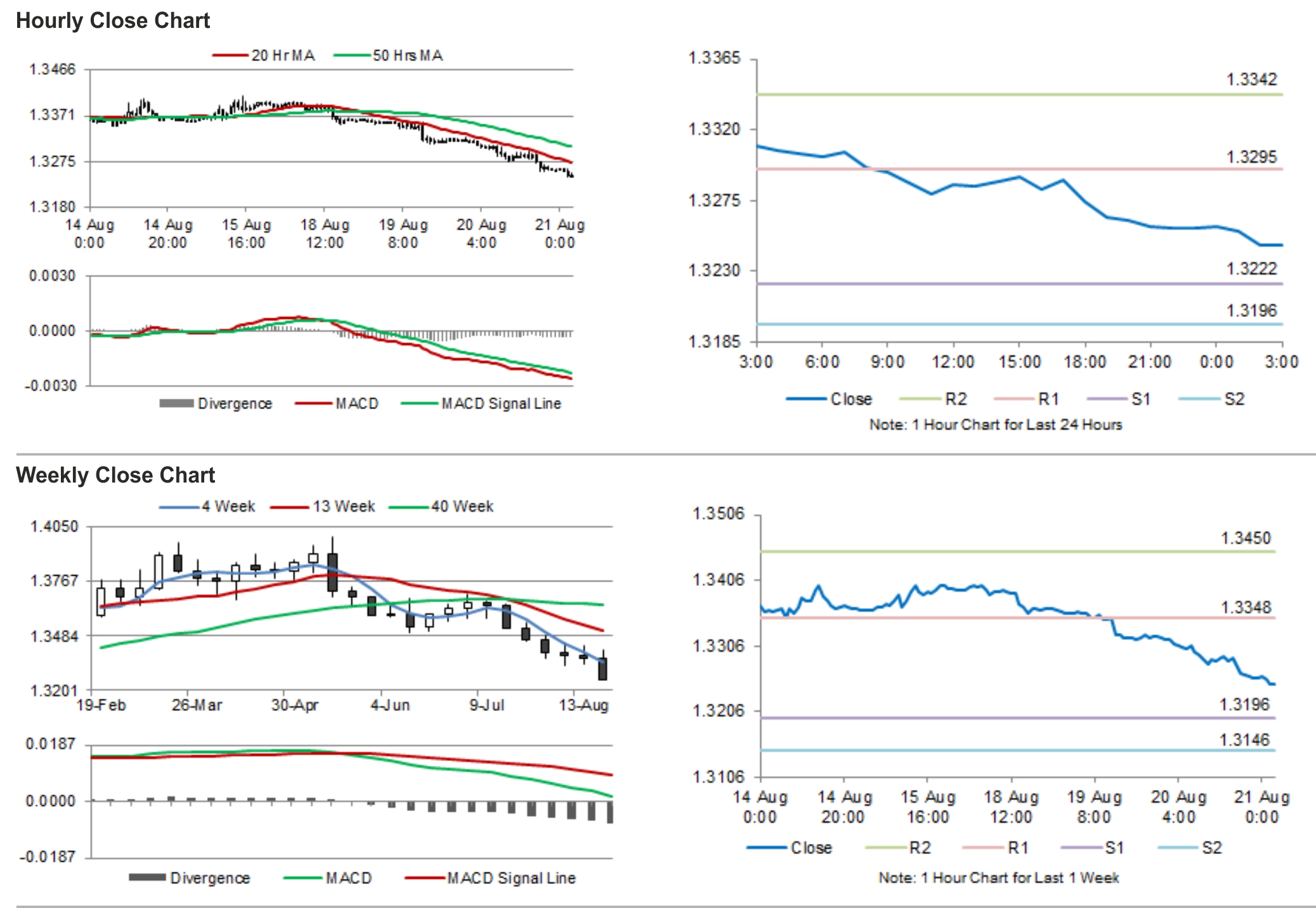

The pair is expected to find support at 1.3222, and a fall through could take it to the next support level of 1.3196. The pair is expected to find its first resistance at 1.3295, and a rise through could take it to the next resistance level of 1.3342.

Trading trends in the pair today are expected to be determined by service and manufacturing PMIs from Germany, France as well as the Euro-zone. Investors would also keenly await the Jackson Hole 3-day symposium, which is slated to commence later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.