For the 24 hours to 23:00 GMT, the EUR declined 0.92% against the USD and closed at 1.1239.

In economic news, German factory orders rose 0.9% on a monthly basis in March, following two successive months of decline and compared to a fall of 0.9% recorded in the previous month, thus suggesting that Europe’s biggest economy was showing signs of steady improvement. Markets were expecting it to advance 1.9%.

The greenback traded on a stronger footing, after the seasonally adjusted initial jobless claims in the US advanced less than expected to 265.00 K in the week ended 02 May 2015, compared to market expectations of an advance to a level of 279.00 K, compared to a level of 262.00 K in the prior week.

Other economic data showed that consumer credit in the US recorded a rise of $20.52 billion in March, compared to a revised rise of $14.79 billion in the prior month, while market expectations were for it to climb $15.80 billion

In the Asian session, at GMT0300, the pair is trading at 1.1207, with the EUR trading 0.28% lower from yesterday’s close.

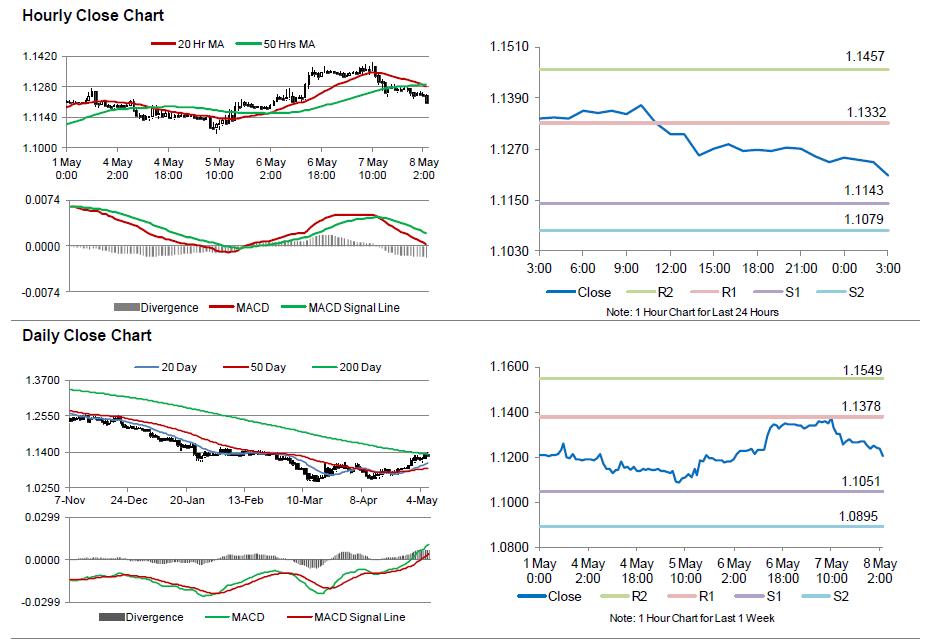

The pair is expected to find support at 1.1143, and a fall through could take it to the next support level of 1.1079. The pair is expected to find its first resistance at 1.1332, and a rise through could take it to the next resistance level of 1.1457.

Trading trends in the Euro today are expected to be determined by Germany’s industrial and trade balance data, scheduled in a few hours. Meanwhile, the US non-farm payrolls data, scheduled later today would grab lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.