For the 24 hours to 23:00 GMT, the EUR rose 0.38% against the USD and closed at 1.2670, after the ECB, in its monetary policy meeting, concluded that it would first see Euro-zone’s economic situation and then only would implement fresh stimulus measures to minimize deflationary threats in the single-currency region. Additionally, the central bank kept its benchmark interest rates unchanged at 0.05%, in line with market expectations. Meanwhile, the ECB Chief Mario Draghi, in the post-policy press conference meeting, announced that the central bank would begin the purchase of covered bonds from the middle of October and asset-backed securities in the fourth quarter and also indicated that the programme will last for two years and will also include the purchase of below investment grade asset-backed securities, including those from Greek and Cypriot banks.

On an annual basis, the producer prices in the Eurozone dropped 1.4% (Y-o-Y), compared to a revised fall of 1.3% in the previous month. In Spain, the number of people unemployed rose 19.7K in September, lower than market expectations of an advance of 31.3K jobs.

In the US, number of initial jobless benefits unexpectedly fell to a level of 287.0 K in the week ended September 27, lower than market expectations of a rise to 297.0K and compared to a revised level of 295.0K registered in the previous week. Similarly, continuous jobless claims dropped to 2,398.0K, compared to a level of 2,425.0K in the week ended September 20. Moreover, the ISM New York City current business condition index surged to 63.7 in September, after registering a level of 57.1 in the prior month. However, the nation’s factory orders unexpectedly declined 10.1% in August, exceeding market expectations for a fall of 9.5% and following 10.5% gain in July.

Separately, the St. Louis Fed President, James Bullard mentioned that the Fed’s bond buying program is having a positive impact on the US labour market and further mentioned that he foresees 3.0% or better growth in the third and fourth quarter of 2014 in the US. He also indicated that the central bank is far behind its schedule on raising interest rates.

In the Asian session, at GMT0300, the pair is trading at 1.2658, with the EUR trading 0.09% lower from yesterday’s close.

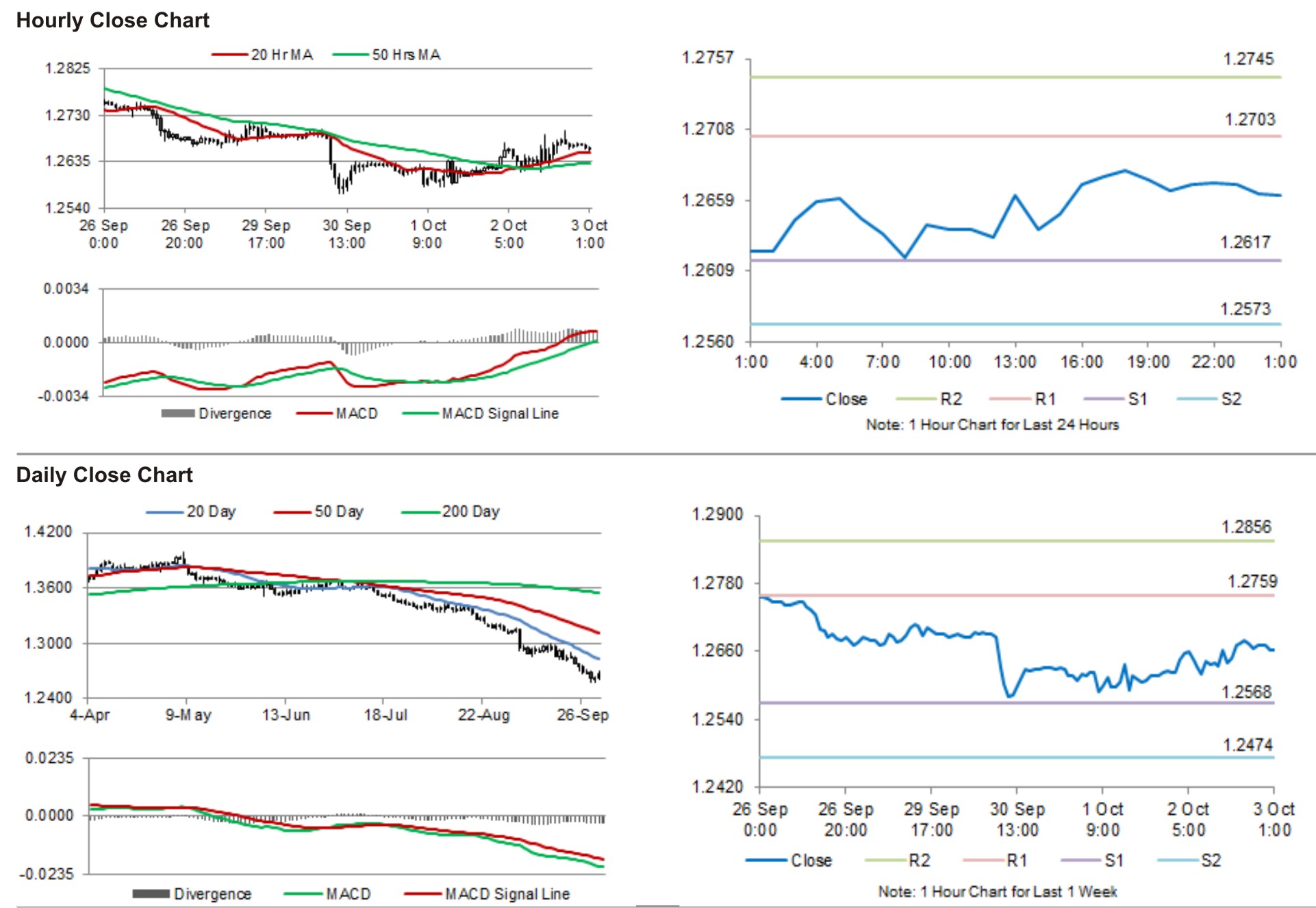

The pair is expected to find support at 1.2615, and a fall through could take it to the next support level of 1.2571. The pair is expected to find its first resistance at 1.2701, and a rise through could take it to the next resistance level of 1.2743.

Trading trends in the Euro today would be determined by services PMI data from Euro-zone’s periphery countries as well as retail sales data from the Euro-region. Meanwhile, investors would also keep a close eye on the US non-farm payrolls data as well unemployment rate, to get a better picture of the nation’s labour market.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.