For the 24 hours to 23:00 GMT, the EUR declined 0.85% against the USD and closed at 1.1084, following mixed economic data in the Euro-zone and Germany.

Data showed that, retail sales in the Euro-Zone climbed 1.1% MoM in January, beating market expectations for a 0.2% rise and compared to revised 0.4% increase recorded in the prior month.

In other economic news, Germany’s final Markit services PMI rose to a level of 54.70 in February, lower than market expectations of a rise to a level of 55.50. Additionally, the Euro-zone’s services PMI unexpectedly dropped to 53.7 in February, following a preliminary reading of 53.9.

In the US, the non-manufacturing composite PMI climbed unexpectedly to a level of 56.90 in February, compared to market expectations of a fall to a level of 56.50. The index had recorded a level of 56.70 in the previous month. Additionally, the nation’s Markit services PMI unexpected edged up to 57.1 in February, compared to market expectations of a reading of 57.0.

In other economic news, the private sector employment registered a rise of 212.00 K in February, following a revised increase of 250.00 K in the previous month, while market anticipations were for it to advance 218.00 K.

The Fed’s Beige Book indicated that the economy continued to expand in most of the Fed’s 12 districts, with Richmond being the sole exception. It also reported that the US economy was growing at a moderate pace through mid-February, despite severe winter storms disrupting activity in some region of the nation.

Yesterday, the President of the Chicago Fed, Charles Evans, indicated that the Fed should not tighten its policy stance until it is confident about the nation’s inflation to reach the 2% target. He further suggested that the central bank should wait until the first half of 2016 before raising interest rates in the US.

Separately, the Kansas City Fed President, Esther George opined that the Fed should hike its interest rates in the middle of this year to avoid any risks that may occur due to acting late.

In the Asian session, at GMT0400, the pair is trading at 1.1066, with the EUR trading 0.16% lower from yesterday’s close.

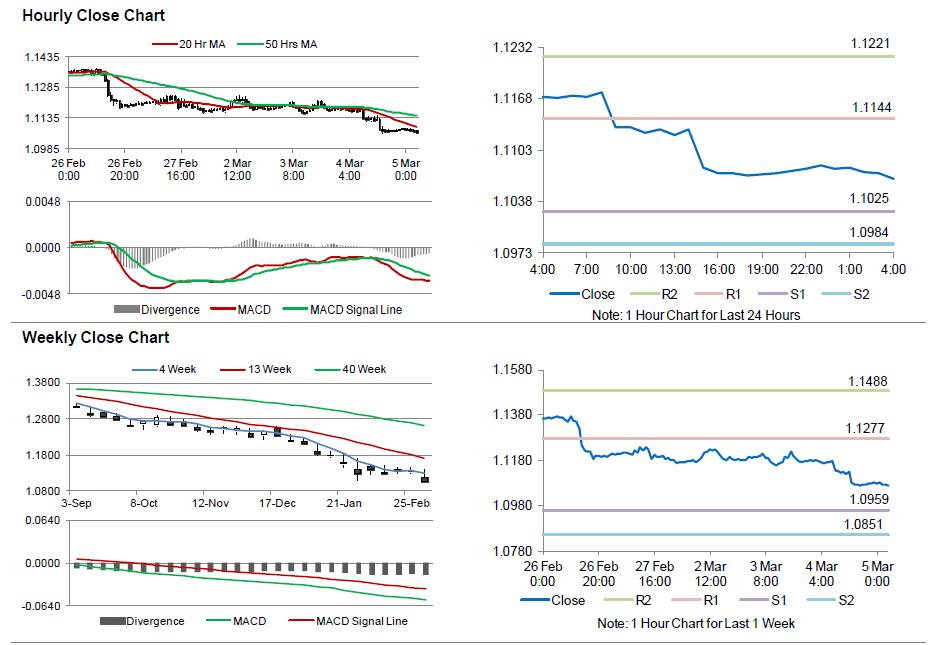

The pair is expected to find support at 1.1025, and a fall through could take it to the next support level of 1.0984. The pair is expected to find its first resistance at 1.1144, and a rise through could take it to the next resistance level of 1.1221.

Trading trends in the Euro today are expected to be determined by the ECB’s interest rate decision, scheduled later today. Meanwhile, weekly initial jobless claims data from the US would also generate lot of market attention, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.