For the 24 hours to 23:00 GMT, the EUR rose 0.3% against the USD and closed at 1.1092.

On the data front, Germany’s seasonally adjusted factory orders remained flat on a monthly basis in May, owing to weak domestic demand. Factory orders had recorded a revised drop of 1.9% in the prior month, while investors had expected it to rise by 1.0%. Additionally, the nation’s construction PMI declined to a level of 50.4 in June, expanding at the weakest pace in 10-months, compared to a reading of 52.7 in the preceding month.

In the US, minutes of the US Federal Reserve’s recent monetary policy meeting revealed that policymakers were increasingly worried about the impact of slowdown in the nation’s job growth and decided that interest rate hike should stay on hold until the central bank is able to handle the consequences of the UK vote on European Union membership.

In other economic news, the US trade deficit widened more-than-expected to $41.1 billion in May, as exports fell amid soft overseas demand, from a trade deficit of $37.4 billion in the previous month. On the other hand, the US services sector rose unexpectedly to a level of 51.4 in June, hitting its highest level in seven months, as new orders surged, thus indicating that the economy is regaining lost steam. Markets expected it to remain steady at a level of 51.3. Additionally, the nation’s ISM non-manufacturing PMI rose above expectations to a level of 56.5 in June, compared to a reading of 52.9 in the prior month. Further, mortgage applications advanced 14.2% in the week ended 01 July 2016, after recording a drop of 2.6% in the prior week.

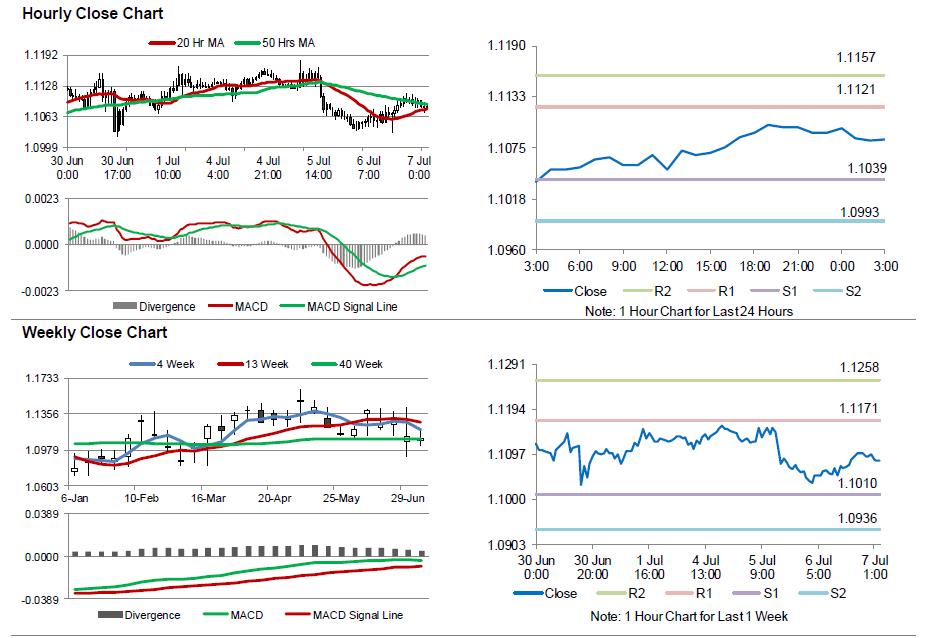

In the Asian session, at GMT0300, the pair is trading at 1.1085, with the EUR trading 0.06% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1039, and a fall through could take it to the next support level of 1.0993. The pair is expected to find its first resistance at 1.1121, and a rise through could take it to the next resistance level of 1.1157.

Looking ahead, investors will keep a close eye on the ECB’s monetary policy meeting accounts report along with Germany’s industrial production data, slated to release today. Additionally, the US weekly jobless claims and the ADP employment change data for June, due later in the day, will also attract investor attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.