For the 24 hours to 23:00 GMT, the EUR rose 0.72% against the USD and closed at 1.0650, on the back of upbeat industrial production in the Euro-zone.

Data showed that industrial production in the Euro-zone climbed 1.1% MoM in February, beating market expectations for a 0.4% rise and compared to a fall of 0.3% recorded in the preceding month.

Yesterday, the IMF hiked its Euro-zone growth forecast to 1.5% in 2015, from 1.2% estimated in January and expects a growth of 1.6% in the next year, up from 1.4%. The IMF also warned that the outlook was fragile, with the Ukraine crisis and uncertainty over Greece’s future in the single currency bloc adding to concerns.

The greenback lost ground, after the US advance retail sales rose 0.9% in March, less than market expected increase of 1.1% and compared to a revised drop of 0.5% in the preceding month. Meanwhile, the small business optimism index in the US recorded an unexpected drop to a level of 95.20 in March, compared to market expectations of an advance to a level of 98.20. The index had recorded a level of 98.00 in the prior month.

The greenback also came under pressure, after the IMF downgraded the US GDP expansion to 3.1% in 2015, down from its previous forecast of 3.6% growth, citing strong dollar as the main setback.

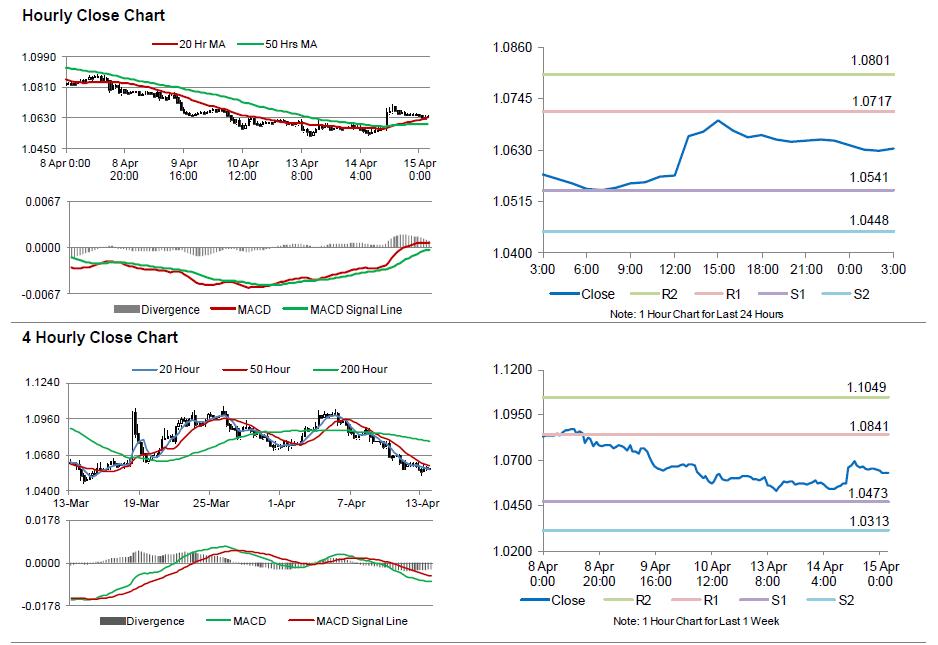

In the Asian session, at GMT0300, the pair is trading at 1.0634, with the EUR trading 0.15% lower from yesterday’s close.

The pair is expected to find support at 1.0541, and a fall through could take it to the next support level of 1.0448. The pair is expected to find its first resistance at 1.0717, and a rise through could take it to the next resistance level of 1.0801.

Trading trends in the Euro today are expected to be determined by the ECB’s interest rate decision coupled with Germany’s CPI data, scheduled today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.