For the 24 hours to 23:00 GMT, the EUR declined 48% against the USD and closed at 1.0832, as investors shrugged off better than expected Germany’s preliminary CPI data.

Data showed that Germany’s preliminary consumer prices climbed 0.50% MoM in March, higher than market expectations for a rise of 0.40%. In the previous month, consumer prices had advanced 0.90%.

In other economic news, the Euro-zone’s economic confidence improved more than expected to a level of 103.9 in March, compared to market expectation of 103.0 and following a level of 102.3 in the previous month.

In the US, core personal consumption expenditure rose 1.40% YoY in February, more than market expectations for a rise of 1.30%. Core personal consumption expenditure had climbed 1.30% in the previous month, while personal income climbed 0.40% in February, beating market expectations for a rise of 0.30%.

Other economic data revealed that pending home sales in the US advanced 3.10% MoM in February, higher than market expectations for an advance of 0.40%. It had risen by a revised 1.20% in the prior month.

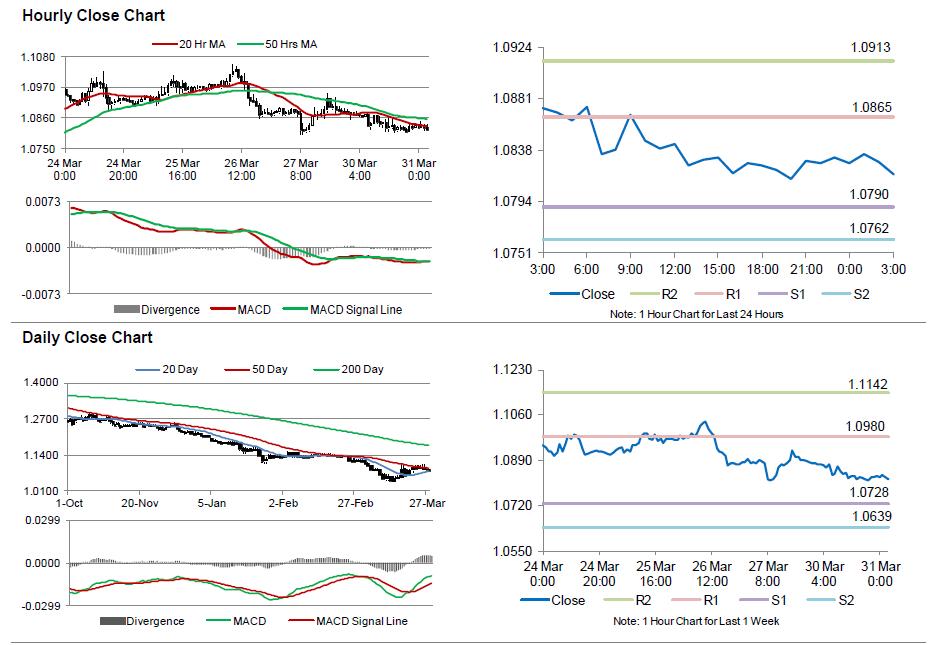

In the Asian session, at GMT0300, the pair is trading at 1.0817, with the EUR trading 0.13% lower from yesterday’s close.

The pair is expected to find support at 1.0790, and a fall through could take it to the next support level of 1.0762. The pair is expected to find its first resistance at 1.0865, and a rise through could take it to the next resistance level of 1.0913.

Trading trends in the Euro today are expected to be determined by Germany’s crucial unemployment rate along with the Euro-zone’s CPI data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.