For the 24 hours to 23:00 GMT, the EUR rose 1.96% against the USD and closed at 1.1217, as uncertainty continued to surround Greece’s bail-out referendum scheduled on 05 July.

Yesterday, a Greek government official mentioned that the nation won’t make a debt repayment of €1.6 billion to the IMF, after the Euro-zone’s ministers disapproved the nation’s request for an extension.

In other economic news, Germany’s preliminary consumer prices registered an unexpected drop of 0.10% on a monthly basis in June, lower than market expectations for an advance of 0.20%. In the previous month, the consumer price index had recorded a rise of 0.10%.

In the US, pending home sales rose 0.90% MoM in May, lower than market expectations for an advance of 1.40%. It climbed by a revised 2.70% in the previous month. Meanwhile, the Dallas Fed manufacturing business index climbed to -7.00 in June, compared to market expectations of an advance to -16.00. In the prior month, the index had registered a level of -20.80.

In the Asian session, at GMT0300, the pair is trading at 1.1188, with the EUR trading 0.26% lower from yesterday’s close.

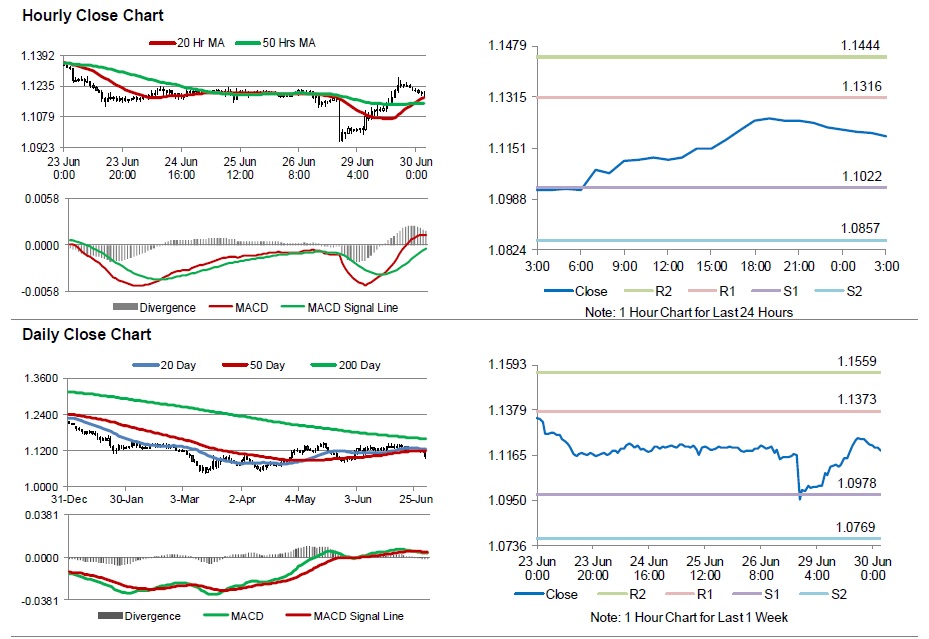

The pair is expected to find support at 1.1022, and a fall through could take it to the next support level of 1.0857. The pair is expected to find its first resistance at 1.1316, and a rise through could take it to the next resistance level of 1.1444.

Trading trends in the euro today are expected to be determined by the Euro-zone’s CPI data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.