For the 24 hours to 23:00 GMT, the EUR declined 0.33% against the USD and closed at 1.2404, after the ECB reported that it issued €129.8 billion in 4-year loans to the Euro-zone banks in the second allotment of the TLTRO program, less than market expected amount of €140 billion. In the previous lending round in mid-September, the ECB had provided €83.0 billion of four-year loans to banks.

In other economic news, the ECB in its recent monthly report indicated that the central bank would reconsider its present monetary policy in early 2015 and then decide to provide further monetary stimulus if required.

Yesterday, data from Germany showed that the nation’s consumer prices remained stagnant on a monthly basis in November, at par with market forecasts. Elsewhere, in Italy, the non-seasonally adjusted industrial production slid 3.0% on a YoY basis in October. In the prior month, industrial production had climbed by a revised 0.3%.

The greenback traded on a stronger footing after the US advance retail sales registered stronger than expected figure in November. The nation’s advance retail sales climbed 0.7% in November, compared to a revised rise of 0.5% in the previous month, while markets were expecting it to rise 0.4%. Additionally, number of people claiming initial jobless claims unexpectedly eased to 294.0 K in the week ended 06 December 2014, compared to market expectations for an unchanged reading of 297.0 K. Meanwhile, continuing jobless claims surprisingly advanced to a level of 2514.0 K in the week ended 29 November, higher than market expected fall to a reading of 2347.0 K. On the other hand, the nation’s business inventories advanced 0.2% in October, meeting market expectations. In the prior month, business inventories had climbed 0.3%.

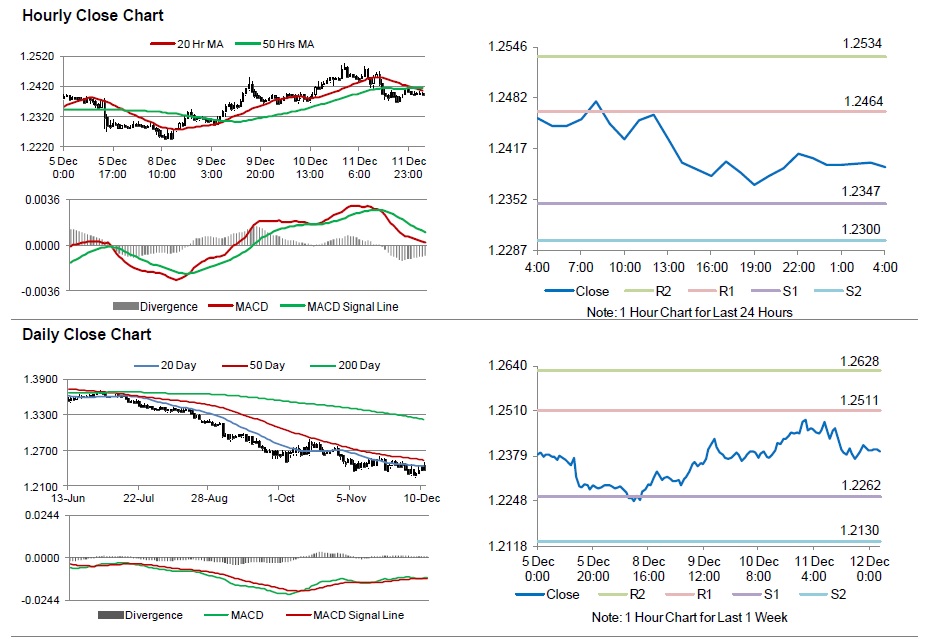

In the Asian session, at GMT0400, the pair is trading at 1.2393, with the EUR trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.2347, and a fall through could take it to the next support level of 1.2300. The pair is expected to find its first resistance at 1.2464, and a rise through could take it to the next resistance level of 1.2534.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s industrial production data, scheduled in a few hours. Meanwhile, investors would also concentrate on the Michigan consumer confidence data, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.