For the 24 hours to 23:00 GMT, the EUR rose 0.40% against the USD and closed at 1.2474, rebounding from its earlier session losses.

In the US, the NFIB small business optimism index rose to a level of 96.10 in October, compared to a level of 95.30 registered in the previous month, while markets expected the index to climb to 95.60. Meanwhile, the nation’s Redbook index on a yearly basis recorded a rise of 3.80% in the week ended 07 November, following a rise of 3.90% recorded in the prior week.

Yesterday, the Philadelphia Fed President, Charles Plosser mentioned in an interview that the Fed should consider raising its benchmark interest rates from ultra-low levels, citing the US unemployment rate sinking to its lowest level since 2008, even as the nation’s inflation still continued to remain below the central bank’s 2% target.

In the Asian session, at GMT0400, the pair is trading at 1.2467, with the EUR trading 0.06% lower from yesterday’s close.

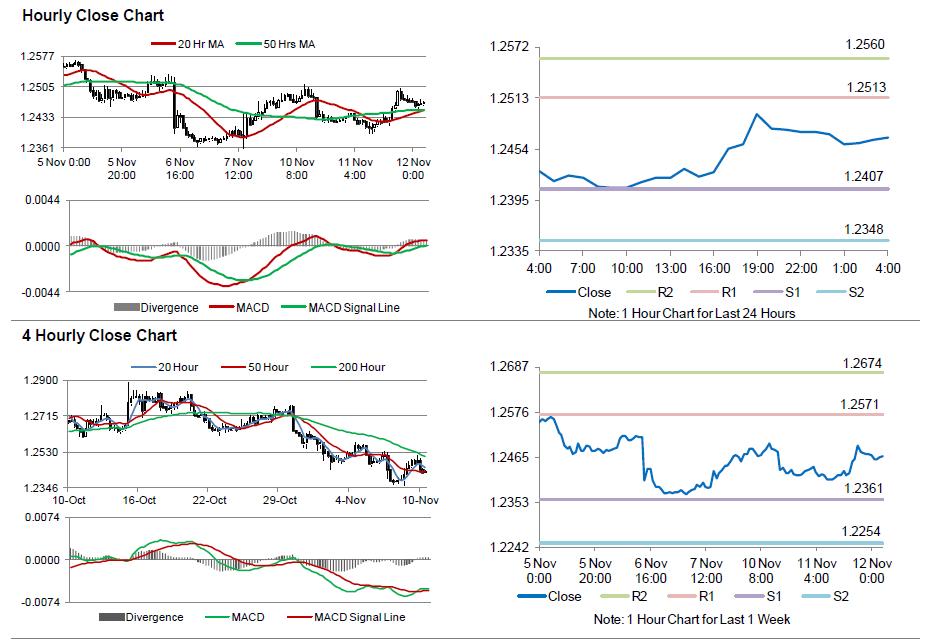

The pair is expected to find support at 1.2407, and a fall through could take it to the next support level of 1.2348. The pair is expected to find its first resistance at 1.2513, and a rise through could take it to the next resistance level of 1.2560.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s industrial production data, set for release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.