For the 24 hours to 23:00 GMT, the EUR rose 1.16% against the USD and closed at 1.0963.

In economic news, the preliminary consumer confidence index in the Euro-zone improved to -3.70 in March, compared to a reading of -6.7 in February. Market expectations were for it to advance to -6.00.

Yesterday, the ECB President, Mario Draghi expressed optimism on Euro-zone’s growth outlook and stated that growth in the region was gaining pace, due to recent fall in global oil prices, improving external demand, depreciation of the Euro and the central bank’s recently launched quantitative easing programme. He further hinted that consumer price inflation in the region was expected to remain low or negative in the near term, amid a fall in energy prices, however, the region’s inflation was anticipated to pick up gradually towards the end of 2015.

In the US, existing homes sales rose 1.2% MoM in February, higher than market expected increase of 2.0% and following a 4.9% drop registered in the previous month.

Separately, the Fed’s Vice Chairman Stanley Fischer opined that the hike in the interest rates from near zero would probably be warranted before the end of 2015. Further he added that the subsequent rate hikes would not be uniform or predictable. Meanwhile, the Cleveland Fed President, Loretta Mester opined that monetary policy easing in the US has created only marginal bubble-like activity in financial markets, and it is limited to certain parts of the stock market. Further, she stated that the Fed would undertake further unconventional actions if the economy weakened.

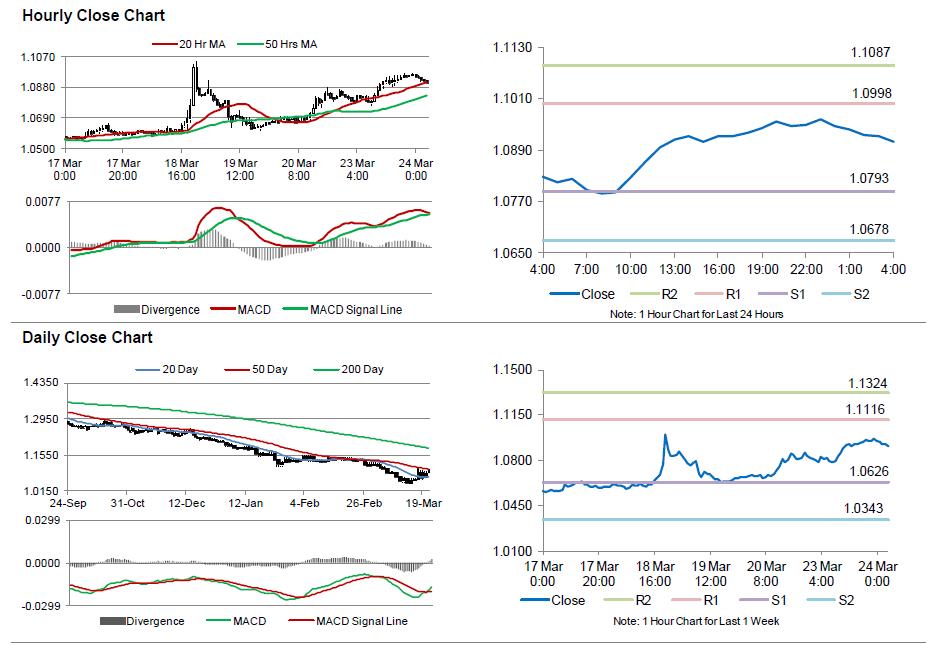

In the Asian session, at GMT0400, the pair is trading at 1.0909, with the EUR trading 0.49% lower from yesterday’s close.

The pair is expected to find support at 1.0793, and a fall through could take it to the next support level of 1.0678. The pair is expected to find its first resistance at 1.0998, and a rise through could take it to the next resistance level of 1.1087.

Trading trends in the Euro today are expected to be determined by the services and manufacturing PMI data from the Euro-zone and its peripheries, scheduled in a few hours. Meanwhile, investors would pay close attention to the US CPI data as well, scheduled later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.