For the 24 hours to 23:00 GMT, the EUR rose 0.10% against the USD and closed at 1.2545, after the Euro-zone’s seasonally adjusted current account surplus widened to €31.0 billion in September, following a surplus of €17.4 billion.

In other economic data, the region’s seasonally adjusted monthly construction output retreated 1.8% in September, compared to a revised gain of 0.7% registered in the prior month.

Yesterday, global credit rating agency S&P, warned the ECB about its monetary stimulus expansionary programme, as according to the agency the risks associated with it could lead to another recession in the entire European economy.

In the US, the Fed minutes from its latest policy meeting in October indicated that the policymakers discussed on the option to retain the pledge to keep interest rates near zero for a “considerable time”. However, later they came to a conclusion that the the timing of rate increases would be depend on the incoming economic data.

In other economic news, building permits in the US surprisingly rose 4.8% on a monthly basis in October, posting its highest reading in close to 7 years, beating market expectations for a drop to a level of 0.9% and after registering a rise of 2.8% in the preceding month. On the other hand, the nation’s monthly housing starts unexpectedly eased 2.8% in October, following a revised increase of 7.8% registered in September, while markets were expecting it to rise 0.8%

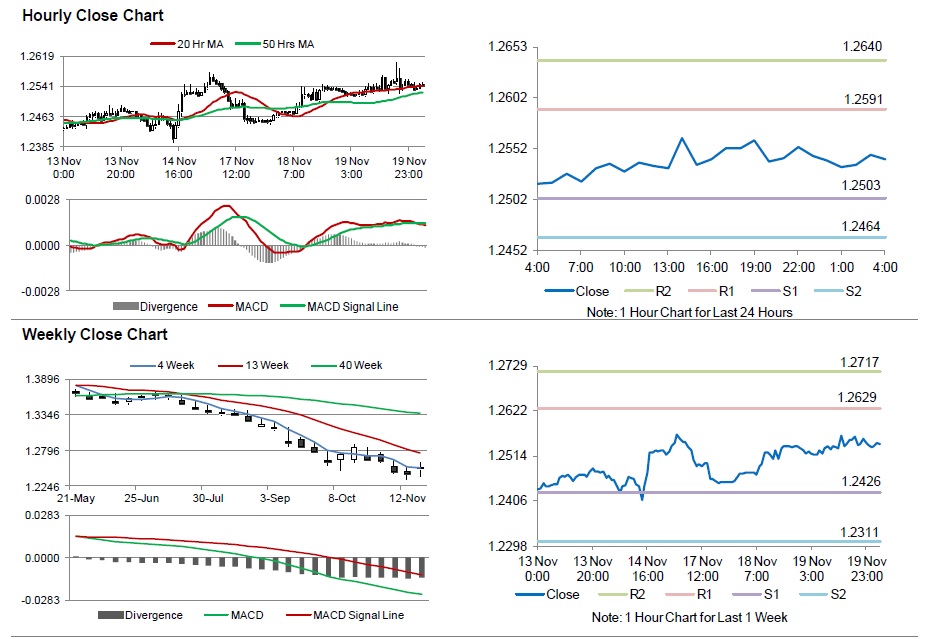

In the Asian session, at GMT0400, the pair is trading at 1.2542, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.2503, and a fall through could take it to the next support level of 1.2464. The pair is expected to find its first resistance at 1.2591, and a rise through could take it to the next resistance level of 1.2640.

Trading trends in the Euro today are expected to be determined by the manufacturing and services PMI data from the Euro-zone and its peripheries, scheduled in a few hours. Meanwhile, the US CPI as well as initial jobless claims data would grab a lot of market attention, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.