On Friday, the EUR rose 0.45% against the USD and closed at 1.0983.

In economic news, the Euro-zone’s CPI estimate rose 0.2% YoY in July, at par with market expectations. Meanwhile, the region’s unemployment rate unexpectedly remained unchanged at 11.1% in June, compared to market expectations of a slight drop to 11.0%.

On the other hand, German retail sales unexpectedly slid 2.3% on a monthly basis in June, compared to revised gain of 0.4% in the previous month. Markets expected it to increase 0.3% in June.

In the US, the employment cost index advanced 0.20% in 2Q 2015, compared to an advance of 0.70% in the previous quarter, while markets anticipated it to rise 0.60%. Also, the final Reuters/Michigan consumer sentiment index dropped to 93.10 in July, following a level of 96.10 in the previous month, while markets expected it to decline to 94.00.

In the Asian session, at GMT0300, the pair is trading at 1.0977, with the EUR trading 0.06% lower from yesterday’s close.

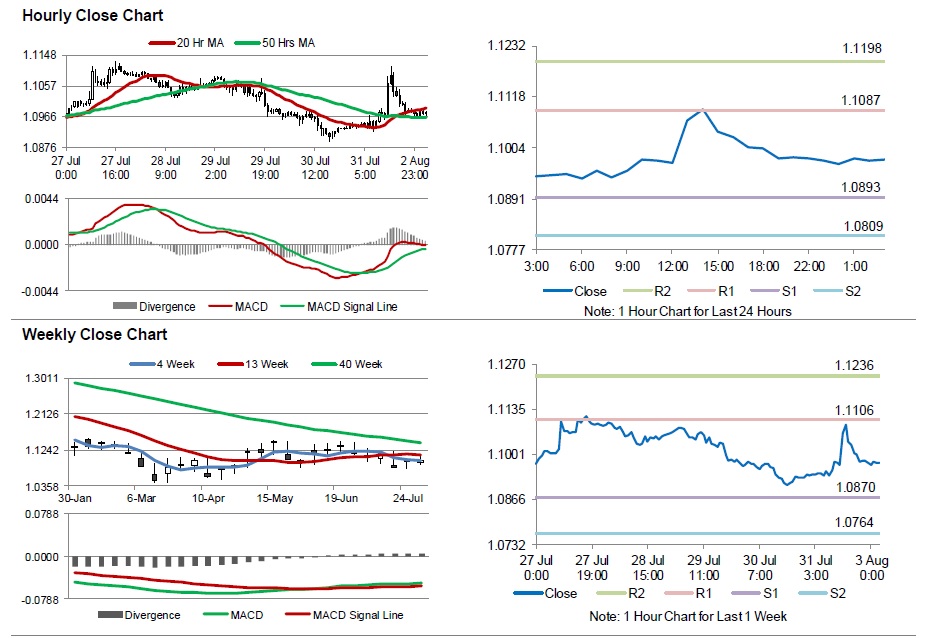

The pair is expected to find support at 1.0893, and a fall through could take it to the next support level of 1.0809. The pair is expected to find its first resistance at 1.1087, and a rise through could take it to the next resistance level of 1.1198.

Trading trends in the Euro today are expected to be determined by the manufacturing PMI data across the Euro-zone, scheduled in a few hours. Additionally, the US ISM manufacturing PMI data, scheduled later today would grab lot of market attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.