For the 24 hours to 23:00 GMT, the EUR declined 1.63% against the USD and closed at 1.2936, following the ECB’s unexpected decision to cut its benchmark interest rates and loosen monetary policy even further.

The ECB lowered its main lending rate to 0.05%, a record low from 0.15% and announced a new economic stimulus program that would involve purchase of covered bonds and asset-backed securities in October.

In other economic data, German factory orders rebounded in August, registering its biggest increase since June 2013. The seasonally adjusted factory orders in the nation rose 4.6%, more than market expectations which called for an advance of 1.5%. The factory orders had fallen by a revised 2.7% in the previous month. Meanwhile, the German construction PMI in August further slipped into contraction territory. Elsewhere, in France, unemployment rate rose to a level of 10.2% in 2Q 2014, meeting market expectations, following a level of 10.1% in the prior quarter.

Yesterday, the ECB Chief, Mario Draghi, in the post policy meeting, cut the growth forecast in the 18-country Euro-area for 2014 to 0.9% from 1.0% while also downgrading the outlook for 2015 to 1.6% from 1.7%. Further, he indicated that the central bank had plans to buy private-sector assets, suggesting that the door was still open for a bout of quantitative easing.

The greenback received a boost from mostly healthy US economic data which continued to reinforce expectations that an interest rate hike may be implemented sooner-than-expected. The ISM non-manufacturing PMI increased to a 41-month high reading of 59.6 in August, from 58.7 in July. Similarly, the trade deficit in the nation surprisingly narrowed to $40.5 billion in July, registering its lowest level since January, from previous month’s deficit of $40.8 billion. Meanwhile, continuing jobless claims in the nation declined to 2.464 million, marking its lowest level since 2007, in the week ended August 23, against market expectations for a fall to 2.510 million and compared to 2.528 million in the preceding week. However, the initial jobless claims rose to 302,000 in the week ended August 30, from the previous week’s total of 298,000. Also, the US Markit services PMI in August, came in at 59.5, beating market expectations for a reading of 58.5

The Dallas Fed President, Richard Fisher, opined that improving labour market condition in the US is building up pressure on the Fed, to go for interest rate hike. Also, the Minneapolis Fed President, Narayana Kocherlakota, indicated that the current Fed interest rate was not low enough to improve the nation’s inflation rate and employment conditions, adding that the central bank must take more measures to boost domestic growth.

The US Fed Governor, Jerome Powell, mentioned that the central bank might move itself closer to a hike in the key interest rate, if job gains and economic growth remains firm.

In the Asian session, at GMT0300, the pair is trading at 1.2934, with the EUR trading marginally lower from yesterday’s close.

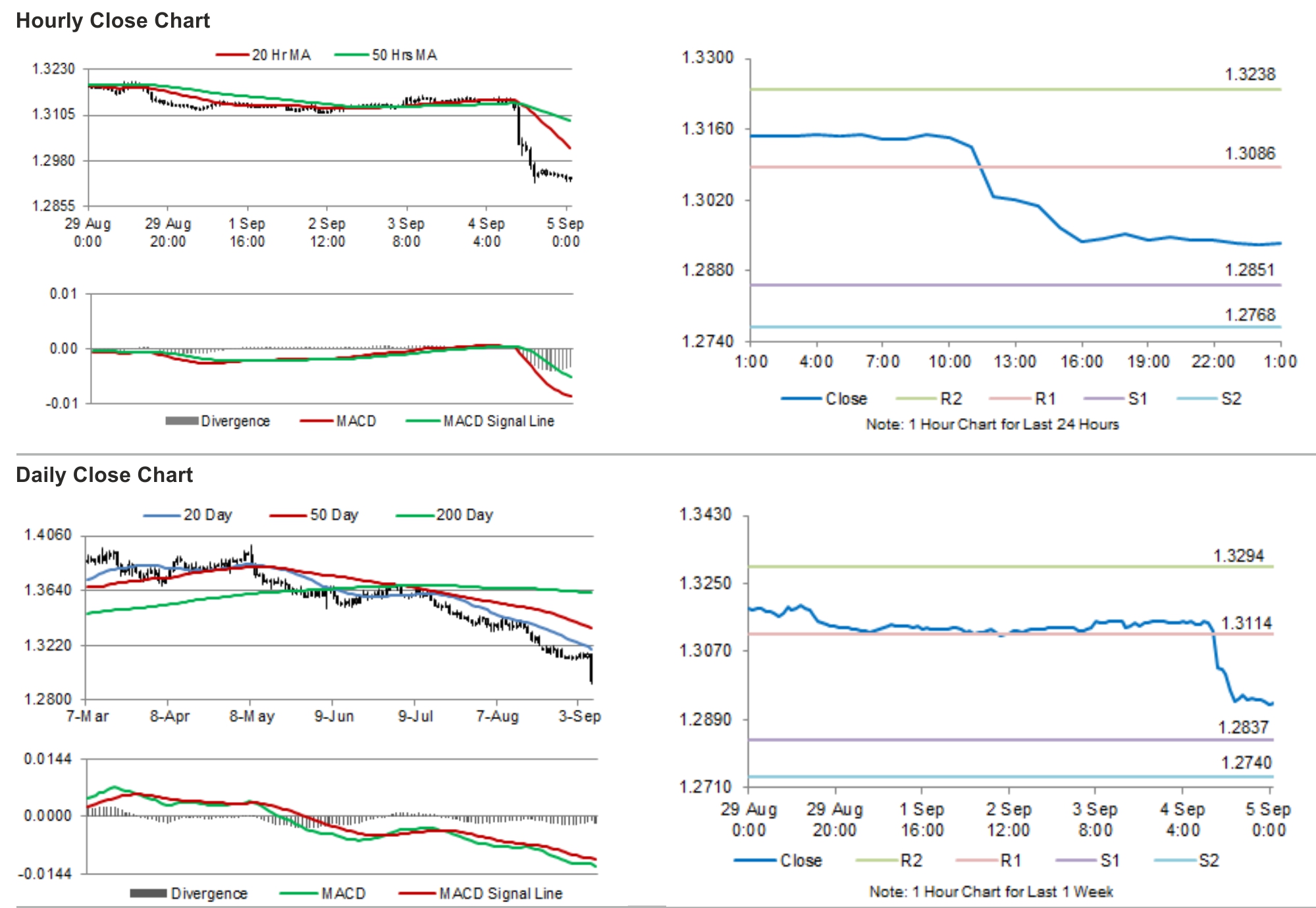

The pair is expected to find support at 1.2851, and a fall through could take it to the next support level of 1.2768. The pair is expected to find its first resistance at 1.3086, and a rise through could take it to the next resistance level of 1.3238.

Trading trends in the pair today are expected to be determined by the much critical 2Q GDP of the Euro-zone scheduled few hours from now, as well as unemployment rate and non-farm payrolls data from the US, slated to release later today

The currency pair is trading below its 20 Hr and 50 Hr moving averages.