For the 24 hours to 23:00 GMT, the EUR declined 0.39% against the USD and closed at 1.1833, following worse than expected inflation figures in the Euro-zone.

Consumer prices in the single-currency region retreated more than expected 0.2% on a YoY basis in December, against market expectations of a 0.1% drop and compared to a rise of 0.3% recorded in the prior month, underlining concerns of deflation in the region and thereby mounting pressure on the ECB to step up its stimulus program immediately. Meanwhile, unemployment rate in the Euro-zone remained steady at 11.5% in November, at par with market estimates.

Elsewhere, in Germany, jobless rate surprisingly dropped to 6.5% in December, lower than market expectations to remain unchanged at previous month’s 6.6%. Meanwhile, retail sales in the nation advanced more than expected 1.0% on a MoM basis, rising for the second-consecutive month in November and after registering a 2.0% gain in the preceding month.

On the other hand, Italy’s CPI stagnated on a monthly basis in December, while unemployment rate surprisingly rose to 13.4% in December, higher than market expectations of a steady reading.

In the US, the minutes of the Fed’s recent monetary policy meeting indicated that majority of policymakers agreed that the central bank was not consider increasing its key interest rates before April 2015.

In other economic news, the US trade deficit narrowed more than anticipated to $39.0 billion in November, against market expectations to decline to $42.0 billion. Additionally, the ADP private sector employment numbers registered a rise of 241.0 K in December, following a revised increase of 227.0 K in the prior month. Market anticipations were for the private sector employment to advance 225.0 K.

Separately, the Chicago Fed President, Charles Evans, stated that the US central bank should not haste in hiking interest rates as the nation’s economy and employment market was improving. He also opined that the US inflation would remain under 2% target for several years.

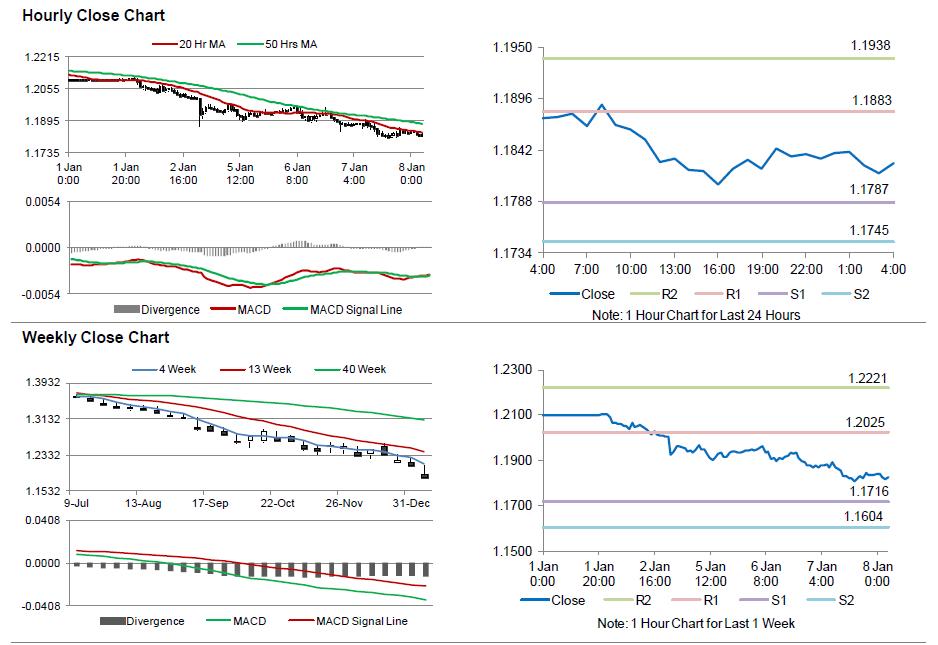

In the Asian session, at GMT0400, the pair is trading at 1.1828, with the EUR trading a tad lower from yesterday’s close.

The pair is expected to find support at 1.1787, and a fall through could take it to the next support level of 1.1745. The pair is expected to find its first resistance at 1.1883, and a rise through could take it to the next resistance level of 1.1938.

Trading trends in the Euro today are expected to be determined by as series of economic releases from the Euro-zone and its biggest economy, Germany, scheduled in few hours. Meanwhile, investors would closely monitor weekly initial jobless claims data from the US, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.