For the 24 hours to 23:00 GMT, the EUR rose 1.84% against the USD and closed at 1.1353.

In economic news, the Euro-zone’s final Markit services PMI surprisingly rose to a three-month high level of 53.3 in May, compared to investor expectations to remain steady at the preliminary reading of 53.1. In the previous month, services PMI had registered a similar reading. On the other hand, the region’s retail sales remained unchanged on a monthly basis in April, compared to a revised fall of 0.6% in the previous month. Market expectation was for retail sales to rise 0.4%. Meanwhile in Germany, final Markit service PMI remained steady at the preliminary reading of 55.2 in May, in line with market expectations. During the previous month, services PMI had registered a reading of 54.5.

The greenback weakened after the US non-farm payrolls rose less-than-expected to a level of 38.0K in May, compared to market anticipations of an advance of 160.0K. Non-farm payrolls had registered a revised increase of 123.0K in the prior month. Meanwhile, the nation’s unemployment rate unexpectedly fell to 4.7% in May, compared to market expectations of a drop to a level of 4.9%. Unemployment rate had registered a level of 5.0% in the prior month.

In other economic news, the US ISM non-manufacturing PMI dropped more-than-expected to a level of 52.9 in May, from a reading of 55.7 in the previous month. Further, the nation’s final durable goods orders remained steady at the preliminary figure of 3.4% in April. Durable goods orders had advanced by a revised 1.9% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1346, with the EUR trading 0.06% lower from Friday’s close.

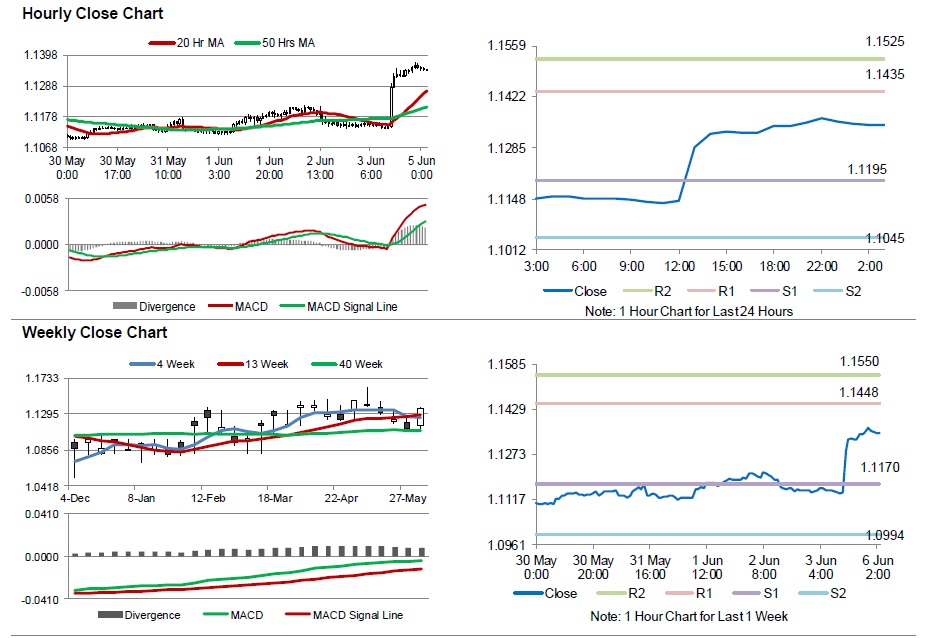

The pair is expected to find support at 1.1195, and a fall through could take it to the next support level of 1.1045. The pair is expected to find its first resistance at 1.1435, and a rise through could take it to the next resistance level of 1.1525.

Moving ahead, investors will look forward to Germany’s factory orders data for April and the Euro-zone’s Sentix investor confidence data for June, scheduled to release in a few hours. Moreover, in the US, the Federal Reserve Chairwoman, Janet Yellen’s speech, due later today, will be closely watched.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.