For the 24 hours to 23:00 GMT, the EUR rose 0.43% against the USD and closed at 1.0807.

Macroeconomic data showed that Germany’s final consumer price index remained flat on a monthly basis in October, meeting expectations. The preliminary figures had also recorded a flat reading. Additionally, industrial production in the Euro-zone fell more-than-expected by 0.3% MoM in September, compared to a revised fall of 0.4% in the previous month. Investors had expected it to decline 0.1%.

Separately, the ECB President, Mario Draghi, stated that signs of a turnaround in the Eurozone’s inflation have weakened and reiterated that the central bank would re-examine its monetary stimulus programme at its December meeting.

In the US, initial jobless claims remained unchanged at a level of 276.0K in the week ended 07 November. Investors had expected it to drop to a level of 270.0K. Further, the nation posted a budget deficit of $136.5 billion in October, following a deficit of $121.7 billion in the same month last year. Markets were anticipating the nation to register a budget deficit of $130.0 billion.

Meanwhile, three of the US Federal Reserve’s top officials, namely, St. Louis Fed President, James Bullard, Fed Vice Chairman, Stanley Fischer and the New York Fed President, William Dudley, expressed confidence in the nation’s economy and rooted for an interest rate hike in December. However, comments from the Chicago Fed President, Charles Evans, turned out to be a dampener as he raised doubts over the central bank’s ability to achieve its 2.0% inflation target.

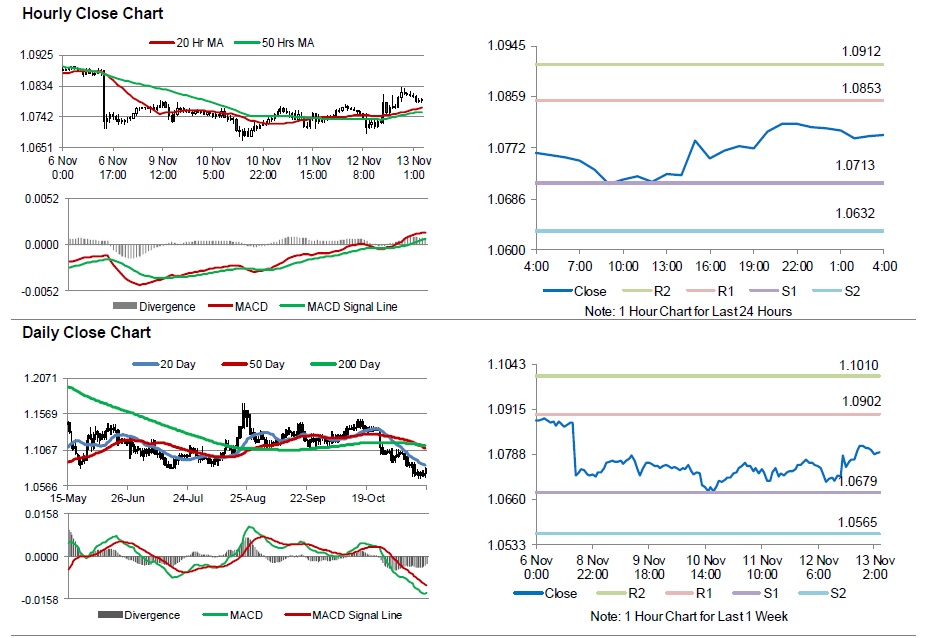

In the Asian session, at GMT0400, the pair is trading at 1.0794, with the EUR trading 0.12% lower from yesterday’s close.

The pair is expected to find support at 1.0713, and a fall through could take it to the next support level of 1.0632. The pair is expected to find its first resistance at 1.0853, and a rise through could take it to the next resistance level of 1.0912.

Going ahead, market participants will look forward to the preliminary Q3 GDP data across the Eurozone, scheduled to be released in a few hours. In addition to this, investors will also closely watch the US retail sales and the flash Reuters/Michigan Consumer Sentiment Index data, scheduled to be released later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.