For the 24 hours to 23:00 GMT, the EUR rose 1.01% against the USD and closed at 1.1157, extending its previous session gains, after Greece and its creditors agreed on a bail-out deal worth €85 billion.

In other economic news, industrial production in the Euro-zone slid more than expected by 0.4% MoM in June, following a revised drop of 0.2% in the preceding month.

In the US, data showed that mortgage applications recorded a rise of 0.10% on a weekly basis, in the week ended 07 August. In the previous week, mortgage applications had climbed 4.70%. Meanwhile, JOLTs job openings fell to a level of 5249.00 K in June, compared to a revised reading of 5357.00 K in the previous month. Markets were expecting it to fall to a level of 5350.00 K.

Other economic data indicated that budget deficit in the US recorded a level of $149.19 billion in July, compared to prior month’s budget surplus of $51.78 billion.

In the Asian session, at GMT0300, the pair is trading at 1.1134, with the EUR trading 0.21% lower from yesterday’s close.

Separately, the New York fed President, William Dudley, opined that, even though the China’s devaluation of its currency would have impact on the global economy, the US economy remained on track for a rate hike in near future, clarifying that the timing of the rate hike would depend on economic data.

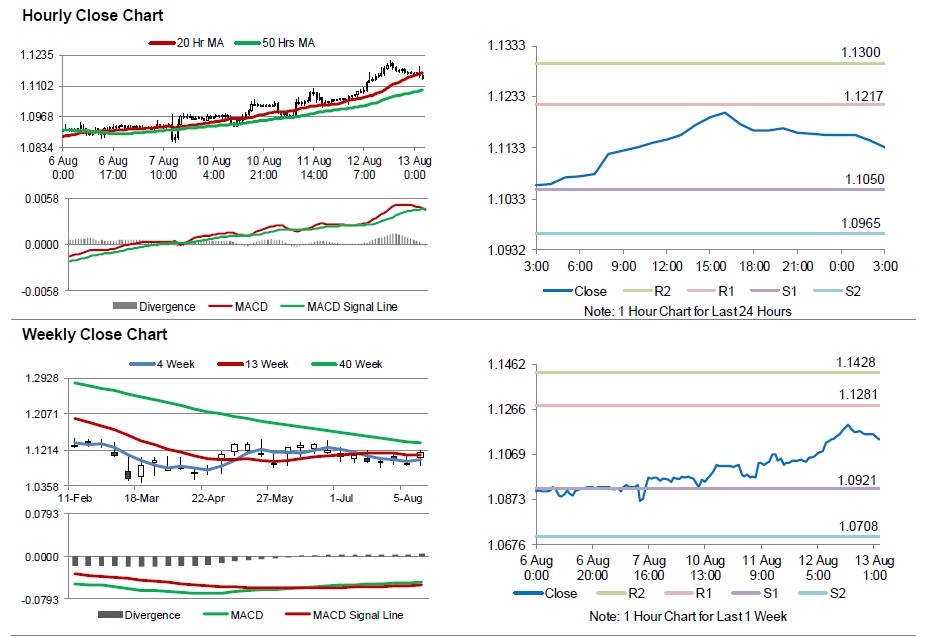

The pair is expected to find support at 1.1050, and a fall through could take it to the next support level of 1.0965. The pair is expected to find its first resistance at 1.1217, and a rise through could take it to the next resistance level of 1.1300.

Trading trends in the Euro today are expected to be determined by Germany’s consumer price inflation data, scheduled in a few hours. Additionally, the US retail sales data, scheduled later today would grab lot of eye-balls as it is expected to rebound strongly.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.