On Friday, EUR declined 0.56% against the USD and closed at 1.2685, after the Gfk consumer confidence in Germany deteriorated for the fifth consecutive month to 8.3 in October, lower than market expectations of a fall to a level of 8.5, thus adding to concerns over a slowdown in the Euro-zone’s biggest economy.

Elsewhere, in France, the consumer confidence remained flat at 86.0 in September, in line with market expectations, while the Italian business confidence index dipped to 95.1 in the same month.

In the US, the annualized GDP grew at a rate of 4.6%, on a quarterly basis, in 2Q 2014, thus registering its fastest rate of expansion since the fourth quarter of 2011, in line with market expectations. It follows 4.2% gain registered in the prior quarter. Additionally, the University of Michigan reported that consumer confidence sentiment in the nation rose to 84.6 in September, registering its highest reading since July 2013, though market expectations were for it to advance to 84.8. Meanwhile, personal consumption in the nation rose 2.5%, on a quarterly basis, in 2Q 2014, after registering a similar increase in the previous month and compared to market expectations for an advance of 2.9%

In the Asian session, at GMT0300, the pair is trading at 1.2678, with the EUR trading 0.06% lower from Friday’s close.

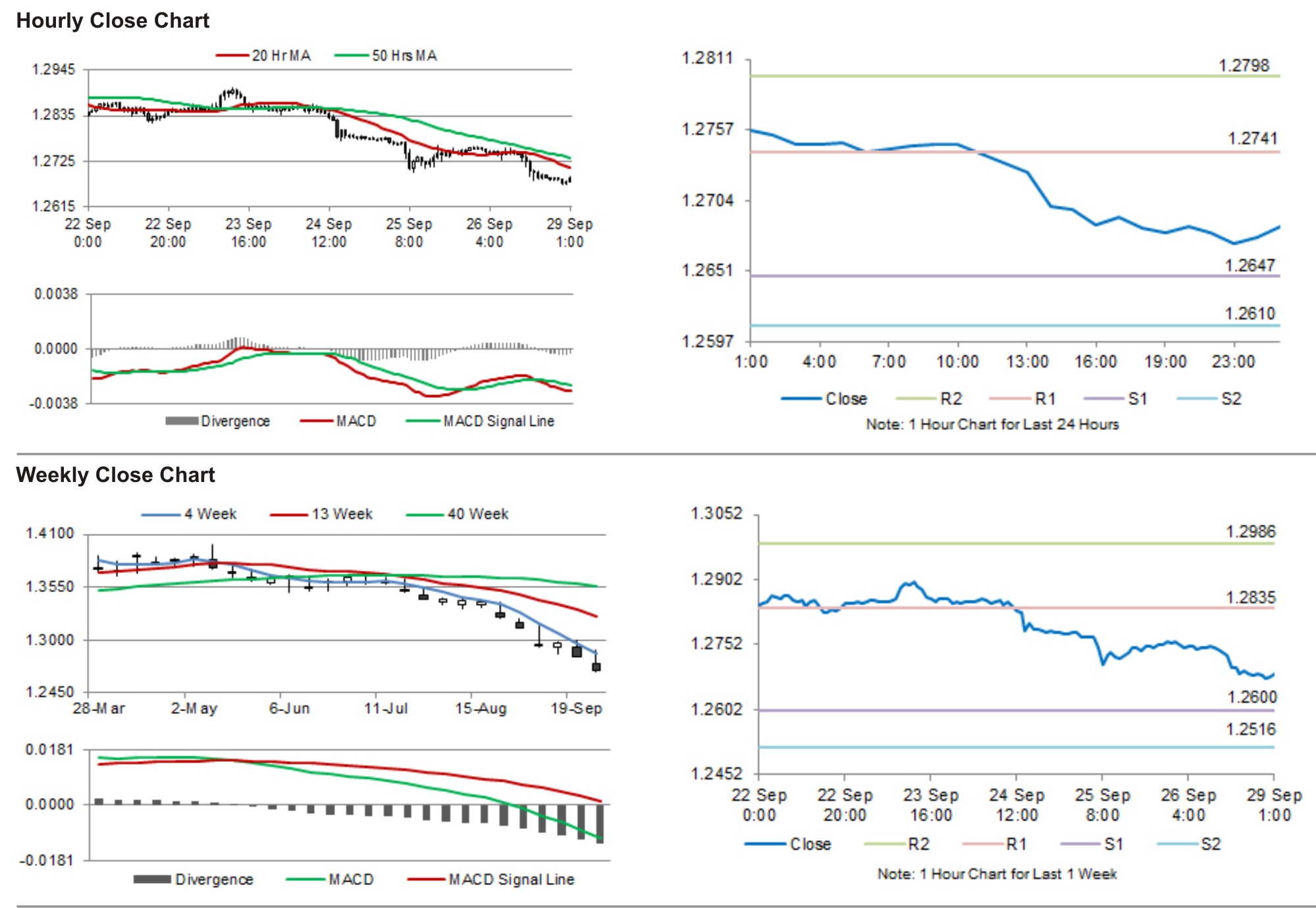

The pair is expected to find support at 1.2644, and a fall through could take it to the next support level of 1.261. The pair is expected to find its first resistance at 1.2735, and a rise through could take it to the next resistance level of 1.2792.

Going forward, investors await Germany’s crucial consumer prices data, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.