For the 24 hours to 23:00 GMT, the EUR declined 0.24% against the USD and closed at 1.1500.

In economic news, the Euro-zone’s producer price index (PPI) rose more-than-expected by 0.3% MoM in March, compared to market expectations for a flat reading. In the previous month, the PPI had recorded a drop of 0.7%.

Meanwhile, the European Commission indicated that growth in the Euro-zone will be slightly weaker this year than previously forecasted, attributing it to the economic slowdown in some of the region’s key trading partners. The Commission lowered its GDP forecast for the Euro-zone to 1.6% and 1.8% in 2016 and 2017 respectively, both 0.1 percentage point lower than projected three months ago.

In the US, the IBD/TIPP economic optimism index advanced above expectations to a level of 48.7 in May, from a reading of 46.3 in the previous month. Market anticipation was for the index to advance to a level of 46.5.

Separately, the Atlanta Fed President, Dennis Lockhart, indicated that two interest rate hikes are certainly possible in 2016. However, he also warned that Britain’s vote to leave the European Union could be a source of heightened global uncertainty.

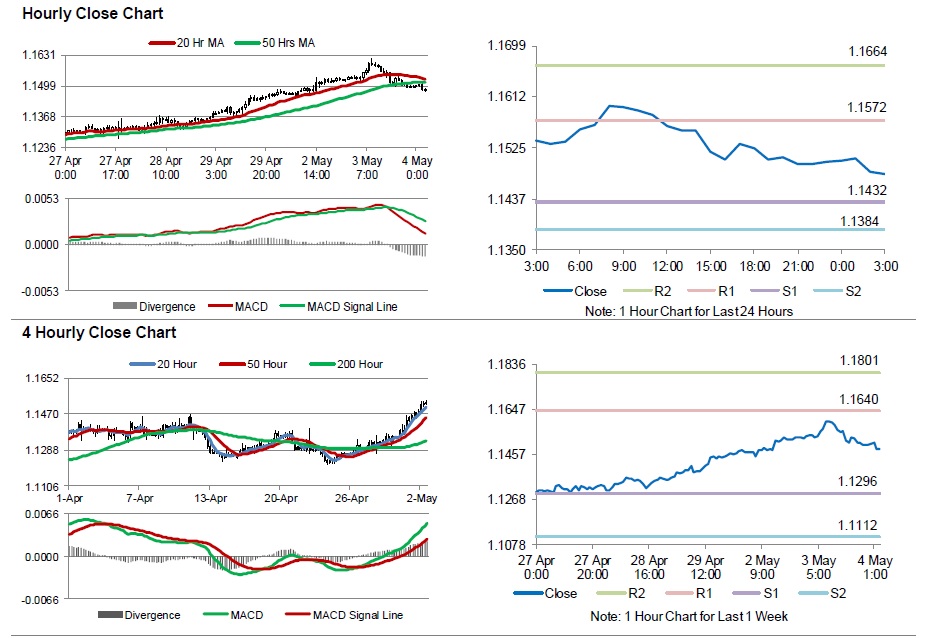

In the Asian session, at GMT0300, the pair is trading at 1.1480, with the EUR trading 0.18% lower from yesterday’s close.

The pair is expected to find support at 1.1432, and a fall through could take it to the next support level of 1.1384. The pair is expected to find its first resistance at 1.1572, and a rise through could take it to the next resistance level of 1.1664.

Going ahead, investors will look forward to the Markit services PMI data across the Eurozone, scheduled to release in a few hours. Moreover, the US trade balance, durable goods orders and the Markit services PMI data, due later in the day, will also attract a significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.