For the 24 hours to 23:00 GMT, the EUR declined 0.44% against the USD and closed at 1.0965, after the ECB President Mario Draghi reiterated the dovish statements he made in October.

The ECB President repeated his stance that the central bank would decide on the degree of monetary stimulus at its next meeting in December. He further mentioned that the ECB is “willing and able to use all instruments available” with it, if needed, in order to achieve the required state of monetary accommodation.

In the US, data showed that factory orders fell for the second consecutive month, by 1.0% in September, compared to a downwardly revised fall of 2.1% in the previous month. Investors had expected it to decline 0.9%. Other economic data showed that economic optimism index in the US unexpectedly dropped to a level of 45.50 in November, following a reading of 47.30 in the previous month. Markets were anticipating it to advance to a level of 47.40.

In the Asian session, at GMT0400, the pair is trading at 1.0952, with the EUR trading 0.12% lower from yesterday’s close.

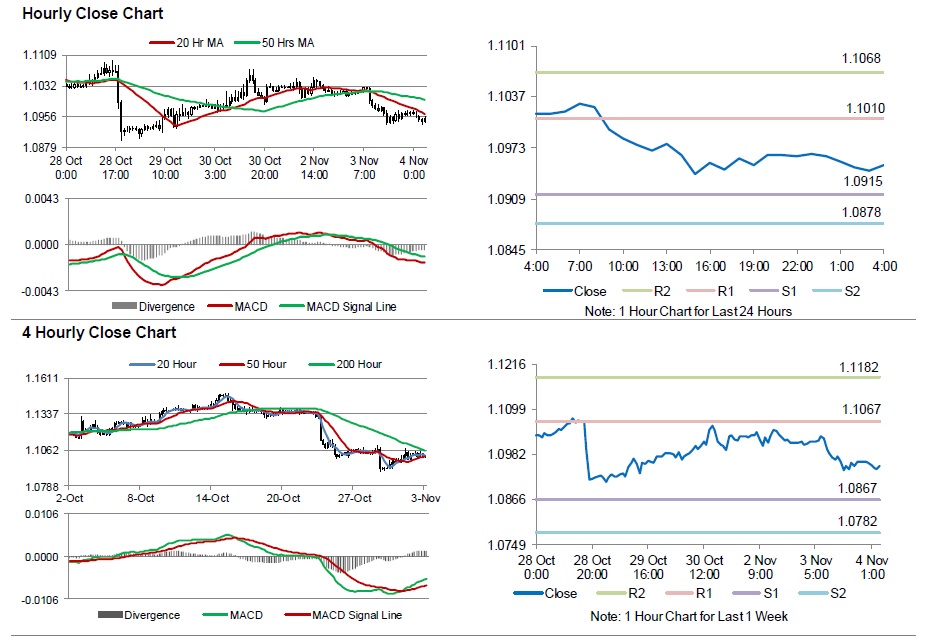

The pair is expected to find support at 1.0915, and a fall through could take it to the next support level of 1.0878. The pair is expected to find its first resistance at 1.1010, and a rise through could take it to the next resistance level of 1.1068.

Moving ahead, market participants will closely watch the Markit services PMI across the Euro-zone for October, scheduled to be released in a few hours. Additionally, the US ADP employment change, Markit services PMI and the ISM non-manufacturing PMI data, all for the month for October, scheduled to be released later in the day, will garner a lot of investor attention. Moreover the Federal Reserve Chairperson, Janet Yellen’s speech will also be scrutinized by investors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.