For the 24 hours to 23:00 GMT, the EUR rose 2.25% against the USD and closed at 1.0832. The greenback lost ground, after the Fed lowered the US economic and inflation outlook for this year and remained dovish on the pace of interest rate increase in the nation.

Yesterday, the Fed at its latest monetary policy meeting held its interest rate steady at 0.25%, at par with market expectations and indicated that the US central bank was moving closer to a much anticipated first interest rate hike since 2006 by dropping “patient” from its statement. However, it trimmed the US GDP estimates for the current year to between 2.3% to 2.7%, 30 basis points below its earlier projection. The Fed also expects Inflation to likely fall below its earlier forecasts, with core PCE inflation expected to hover between 1.3% to 1.4% this year before rising to between 1.5% and 1.9% in the next year.

Elsewhere, the Euro-zone’s seasonally adjusted construction output rose 1.9% on a monthly basis in January, compared to a revised advance of 0.2% recorded in the prior month. Meanwhile, the region’s trade surplus narrowed more than expected to €7.9 billion in January, compared to market expectations of a surplus of €15.0 billion and following a trade surplus of €24.3 billion in December.

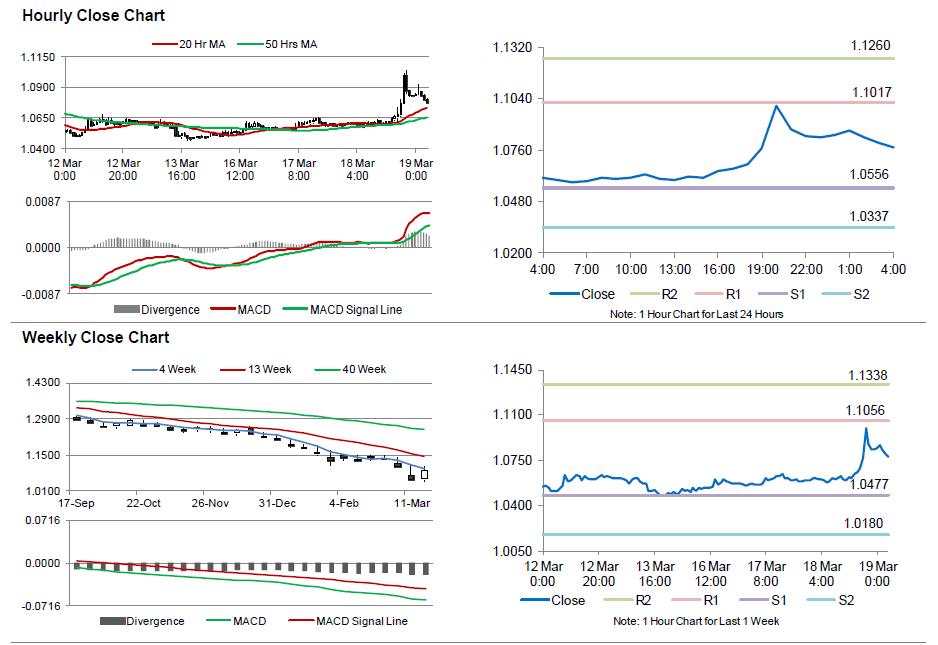

In the Asian session, at GMT0400, the pair is trading at 1.0774, with the EUR trading 0.53% lower from yesterday’s close.

The pair is expected to find support at 1.0556, and a fall through could take it to the next support level of 1.0337. The pair is expected to find its first resistance at 1.1017, and a rise through could take it to the next resistance level of 1.1260.

Trading trends in the pair today are expected to be determined by the US initial jobless claims data, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.