On Friday, the EUR rose 0.44% against the USD and closed at 1.0865, following positive IFO economic data in Germany.

Data showed that Germany’s IFO business climate index edged up more than expected to 108.6 in April and notched its highest reading since June 2014, compared to prior month’s level of 107.9. Meanwhile, the nation’s IFO business expectations index surprisingly dropped to 103.5 in April, following previous month’s reading of 103.9. Markets were expecting it to rise to 104.5

Separately, the Euro-zone Finance Ministers warned Greece that it will get no more assistance until it agrees a complete economic reform plan, as the nation was inching closer to bankruptcy.

In the US, durable goods orders rebounded more than expected by 4.0% in March, beating market expectations for a 0.6% rise and compared to a 1.4% drop registered in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 1.0855, with the EUR trading 0.09% lower from Friday’s close.

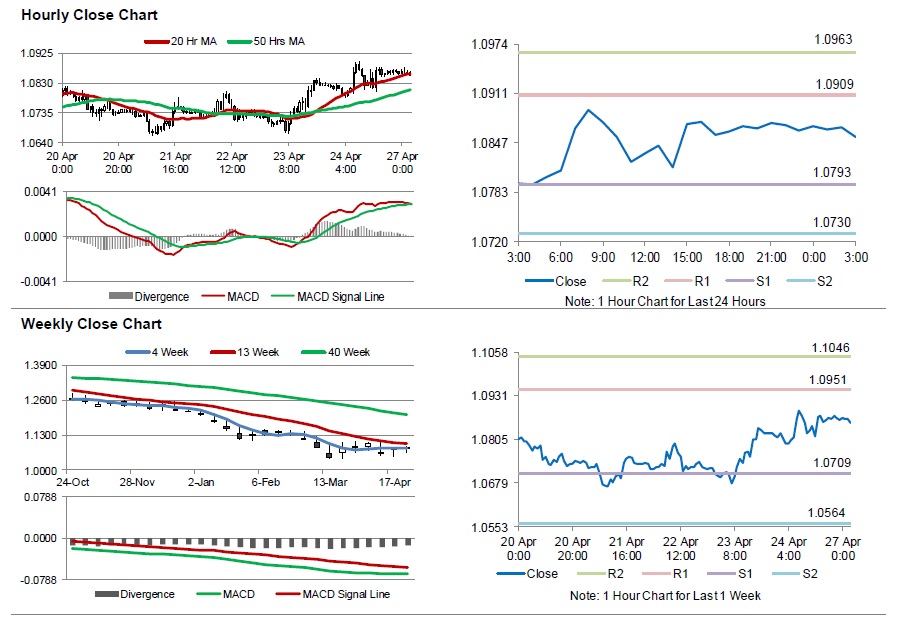

The pair is expected to find support at 1.0793, and a fall through could take it to the next support level of 1.0730. The pair is expected to find its first resistance at 1.0909, and a rise through could take it to the next resistance level of 1.0963.

Trading trends in the pair today are expected to be determined by the US Markit services PMI data, scheduled later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.