For the 24 hours to 23:00 GMT, the EUR declined 0.20% against the USD and closed at 1.0980, amid fears that Greece will not be able to meet upcoming debt repayments.

On Friday, revised data showed that Germany’s GDP growth was confirmed at 0.30% on a quarterly basis in 1Q 2015, compared to an advance of 0.70% in the prior quarter.

Other economic data showed that Germany’s IFO business climate index dropped to 108.50 in May, higher than market expectations of a fall to a level of 108.30. The index had registered a reading of 108.60 in the prior month, while the nation’s IFO business expectations eased to 103.00, compared to a revised level of 103.40 in the previous month.

In the US, data released on Friday indicated that the US consumer price index rose 0.10% MoM in April, at par with market expectations. In the previous month, the consumer price index had recorded a rise of 0.20%.

In the speeches, the Fed Chairperson, Janet Yellen opined that the central bank remained on track to tighten monetary policy for the first time in six years in 2015. Also, she expected the US economy to rebound after a surprisingly weak first quarter.

Separately, the Cleveland Fed President, Loretta Mester opined that the pickup in the US inflation, growth and strong improvement in labour market are pushing the nation’s economy to a level where it can support higher interest rates. Further, she added that the FOMC would keep an open mind about interest rate hikes in its upcoming meeting in June this year.

In the Asian session, at GMT0300, the pair is trading at 1.0945, with the EUR trading 0.32% lower from yesterday’s close.

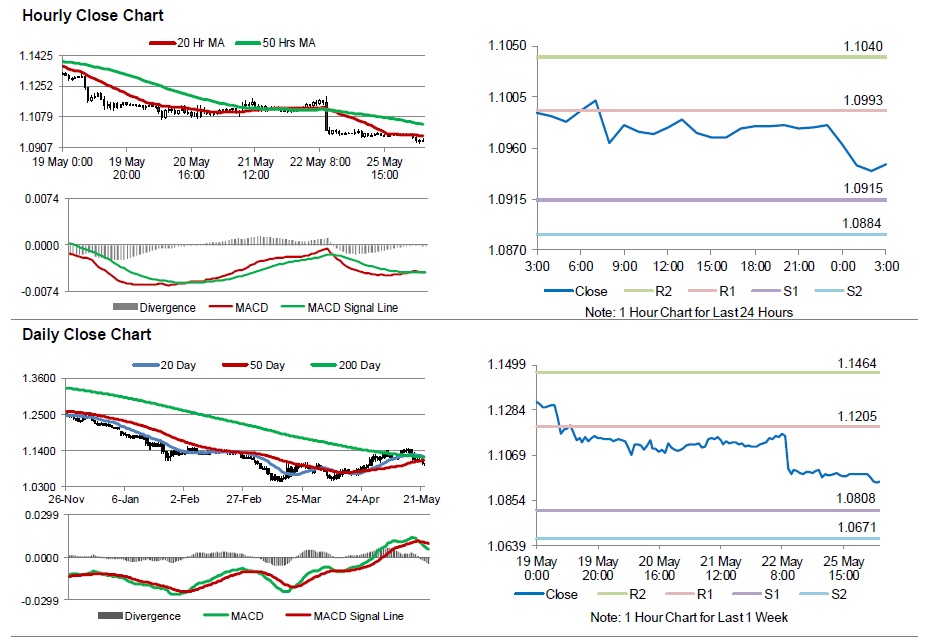

The pair is expected to find support at 1.0915, and a fall through could take it to the next support level of 1.0884. The pair is expected to find its first resistance at 1.0993, and a rise through could take it to the next resistance level of 1.1040.

Amid no economic releases in the Euro-zone today, trading trend in the pair would be determined by the US durable goods orders data, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.