For the 24 hours to 23:00 GMT, the EUR traded marginally lower against the USD and closed at 1.1203, after debt negotiations between Greece and the Euro-zone finance ministers collapsed again, after the nation rejected revised set of proposals from its creditors.

In other economic news, Germany’s Gfk consumer confidence index fell unexpectedly to 10.10 in July, lower than market expectations of an unchanged reading. In the prior month, the consumer confidence index had registered a level of 10.20.

In the US, the seasonally adjusted initial jobless claims recorded a rise to 271.00 K in the week ended 20 June 2015, compared to a revised level of 268.00 K in the prior week, while markets were expecting it to climb to 273.00 K. Meanwhile, the US services sector lost some momentum in June, after the nation’s services PMI unexpectedly eased to 54.8 from 56.2 in May.

Other economic data showed that personal consumption expenditure deflator climbed 0.30% MoM in May, at par with market expectations, compared to a flat reading in the previous month.

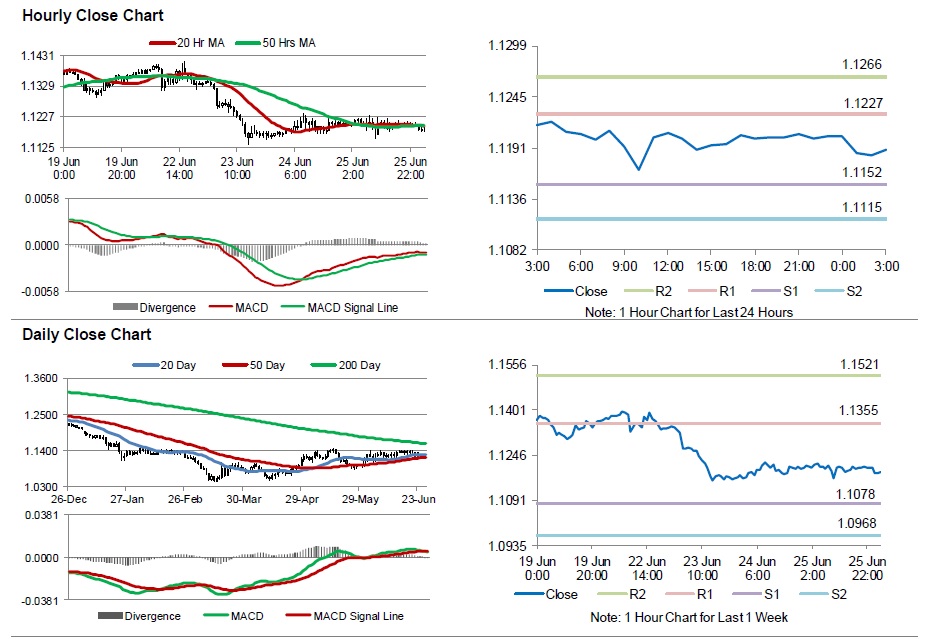

In the Asian session, at GMT0300, the pair is trading at 1.1188, with the EUR trading 0.13% lower from yesterday’s close.

The pair is expected to find support at 1.1152, and a fall through could take it to the next support level of 1.1115. The pair is expected to find its first resistance at 1.1227, and a rise through could take it to the next resistance level of 1.1266.

Going forward, the Euro-zone finance ministers will meet again on Saturday, as Greece’s bailout is set to expire on 30 June. Additionally, the US Michigan consumer confidence index, scheduled later today would be closely monitored by investors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.