For the 24 hours to 23:00 GMT, the EUR rose 0.30% against the USD and closed at 1.1056, as uncertainty remained over Greece’s future in the Euro-zone.

Yesterday, the German Chancellor, Angela Merkel as well as the French President, Francois Hollande urged Greece to come up with fresh proposals quickly, to avoid its expulsion from the common-currency bloc.

On the macro front, German factory orders fell 0.2% MoM, dropping for the first time in three months in May, compared to an increase of 2.2% in the preceding month, as Greece’s financial crisis weighed on orders from other countries in the Euro-zone.

Other economic data showed that the Euro-zone’s Sentix investor confidence advanced unexpectedly to a four-month high level of 18.5 in July from 17.1 in June, regardless of doubts over Greece’s future in the Euro-zone. It was forecasted to fall to a reading of 15.0.

In the US, the ISM non-manufacturing PMI rose less than expected to a level of 56.0 in June. It followed a reading of 55.7 registered in the previous month. Meanwhile, the final reading of services PMI in the nation remained unchanged at 54.8 in June.

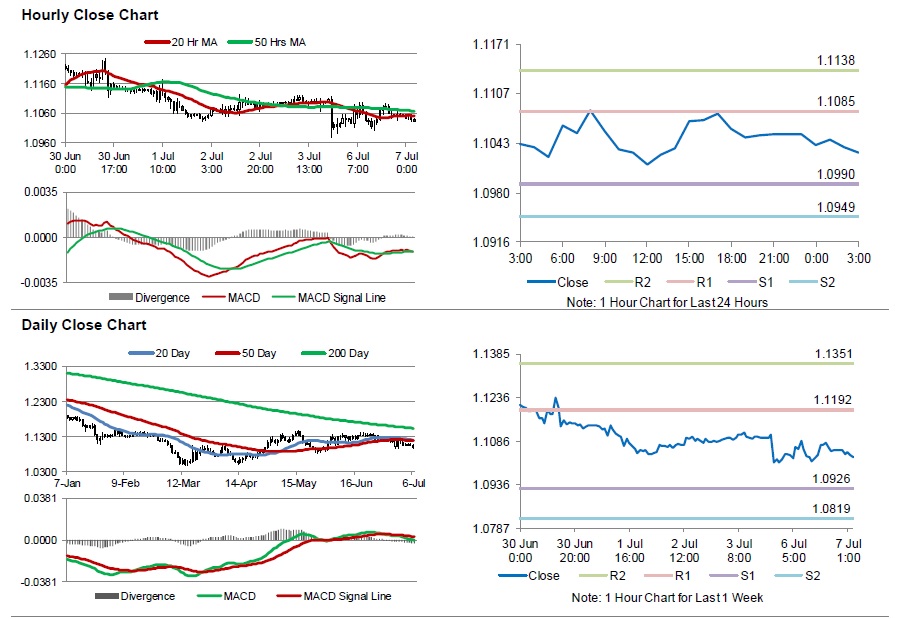

In the Asian session, at GMT0300, the pair is trading at 1.1032, with the EUR trading 0.21% lower from yesterday’s close.

The pair is expected to find support at 1.099, and a fall through could take it to the next support level of 1.0949. The pair is expected to find its first resistance at 1.1085, and a rise through could take it to the next resistance level of 1.1138.

Trading trends in the Euro today are expected to be determined by the outcome of the meeting between the Greek PM Alexis Tsipras and the Euro-zone leaders scheduled later today, after the nation voted to reject the terms of a bailout proposed by its creditors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.