On Friday, the EUR rose 0.66% against the USD and closed at 1.1144, as possibility of the “Grexit” was reduced, after the Greek government had submitted fresh set of proposals to its lenders to strike a bail-out deal with them.

In the US, the Fed Chairperson, Janet Yellen mentioned that the central bank is on track to introduce an interest rate hike in this year. However, she expressed concerns that the path of economic growth and the inflation in the US remains largely uncertain.

Separately, the Boston Fed President, Eric Rosengren, stated that the US central bank should tighten its ultra-lose monetary policy meeting at its upcoming FOMC meeting in September, if the nation’s economy continues to improve.

In other economic news, wholesale inventories in the US rose 0.8% in May, beating market expectations of an increase of 0.3% and compared to previous month’s advance of 0.4%.

In the Asian session, at GMT0300, the pair is trading at 1.1130, with the EUR trading 0.12% lower from Friday’s close.

Over the weekend, the EU’s special summit about Greece’s place in the single currency zone was called off, after a meeting of the Euro-zone Finance Ministers with the Greek government was suspended on Saturday, as both the parties failed to reach an agreement.

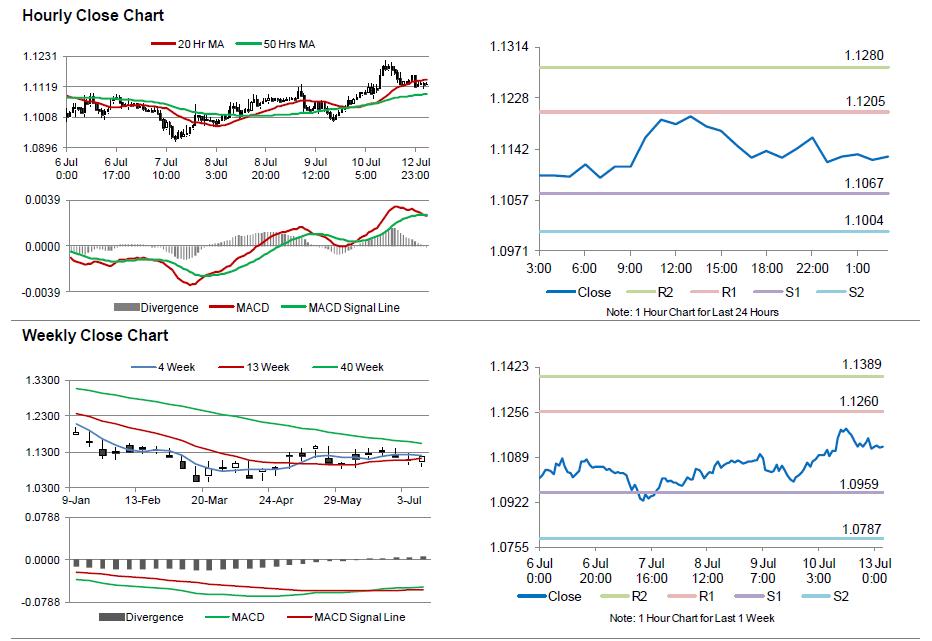

The pair is expected to find support at 1.1067, and a fall through could take it to the next support level of 1.1004. The pair is expected to find its first resistance at 1.1205, and a rise through could take it to the next resistance level of 1.1280.

Meanwhile, the debt ridden nation will continue to remain in the spotlight, until it actually finalises a deal with its creditors.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.