For the 24 hours to 23:00 GMT, the EUR declined 0.57% against the USD and closed at 1.1529. The greenback soared after August’s consumer confidence in the US rose to its second highest level since the end of the recession, climbing to 101.5, from a revised level of 91.0 in July. July’s new home sales, S&P/Case-Shiller home price index in June as well as the housing price index in June climbed less than market expectations.

However, the flash Markit services PMI in the US fell to a level of 55.20 in August, compared to market expectations of a fall to 55.60. The Richmond Fed manufacturing index dropped to 0.00, compared to market expectations of a drop to 10.00.

Meanwhile, losses were capped to an extent after Germany’s seasonally adjusted final GDP rose 0.40% QoQ in 2Q 2015, in-line market expectations as well as the preliminary number. Germany’s IFO survey’s headline business climate index rose to 108.3, from 108 in July. Additionally, the IFO current assessment index rose to 114.8 in this month, up from previous month’s reading of 113.9, while the IFO expectations index fell less than expected to 102.2 in August, from 102.3 in July.

In the Asian session, at GMT0300, the pair is trading at 1.1523, with the EUR trading marginally lower from yesterday’s close.

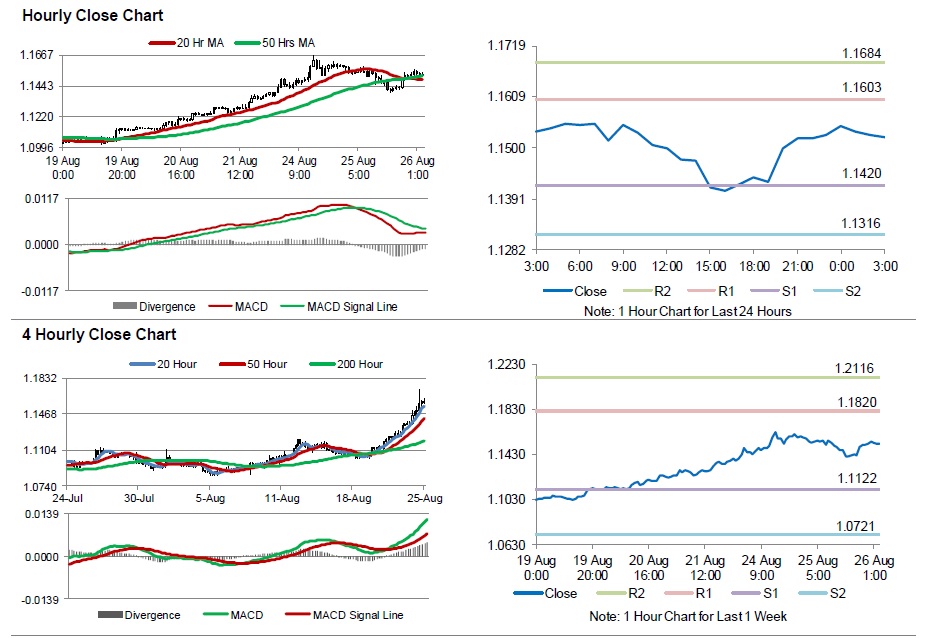

The pair is expected to find support at 1.142, and a fall through could take it to the next support level of 1.1316. The pair is expected to find its first resistance at 1.1603, and a rise through could take it to the next resistance level of 1.1684.

Amid a lack of any major economic news from the single currency bloc today, trading trends in the Euro are expected to be determined by news across the globe.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.