For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.1759.

On the data front, Italy’s seasonally adjusted industrial production rose more-than-expected by 1.1% on a monthly basis in June, compared to market expectations for an advance of 0.2%. In the previous month, industrial production had recorded a rise of 0.7%.

In the US, data revealed that mortgage applications rebounded 3.0% in the week ended 04 August 2017, after recording a drop of 2.8% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1744, with the EUR trading 0.13% lower against the USD from yesterday’s close.

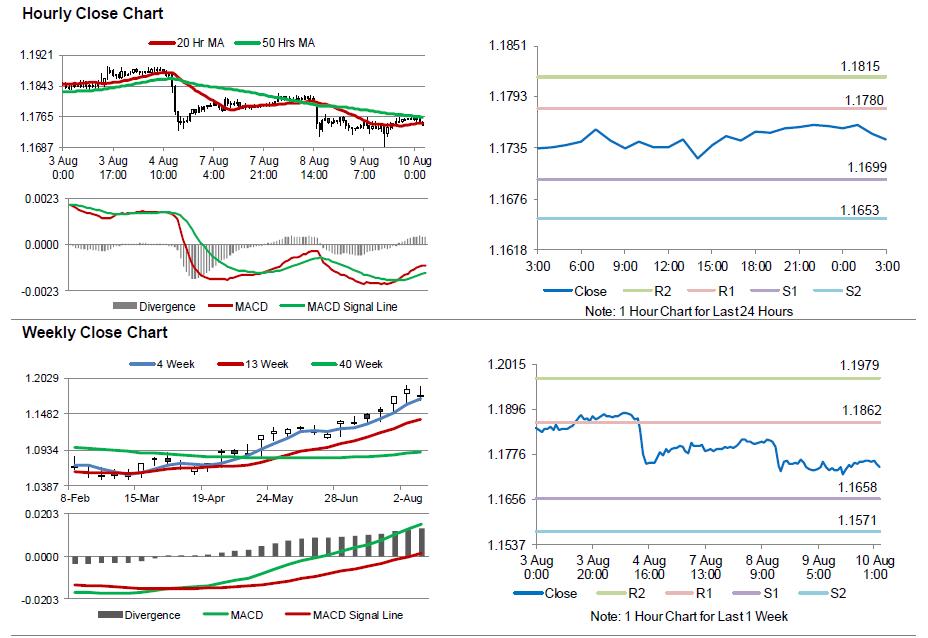

The pair is expected to find support at 1.1699, and a fall through could take it to the next support level of 1.1653. The pair is expected to find its first resistance at 1.1780, and a rise through could take it to the next resistance level of 1.1815.

In absence of any major macroeconomic releases in the Euro-zone today, investors will keep a close watch on the US initial jobless claims and the monthly budget statement for July, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.