For the 24 hours to 23:00 GMT, the EUR declined 0.30% against the USD and closed at 1.1110, amid dovish comments from the European Central Bank Governing Council member, Olli Rehn.

Separately, the US dollar rose against the euro, amid robust retail sales data.

In the US, data showed that advance retail sales rose 0.7% on a monthly basis in July, surpassing market expectations for a rise of 0.3% and following a revised advance of 0.3% in the prior month. Additionally, the NY Empire State manufacturing index unexpectedly advanced to a level of 4.8 in August, defying market expectations for a fall to a level of 2.0. In the previous month, the index had registered a reading of 4.3. Moreover, the the NAHB housing market index unexpectedly climbed to a level of 66.0 in August, defying market expectations for an unchanged reading. The index had recorded a level of 65.0 in the previous month.

On the contrary, the US Philadelphia Fed manufacturing index dropped to a level of 16.8 in August, compared to a level of 21.8 in the previous month. Market participants had expected the index to fall to a level of 9.5. Further, the nation’s manufacturing (SIC) production eased 0.4% on a monthly basis in July, more than market expectations for a fall of 0.3%. In the prior month, manufacturing production had registered a revised rise of 0.6%. Likewise, the US industrial production unexpectedly slid 0.2% on a monthly basis in July, confounding market expectations for an advance of 0.1%. Industrial production had registered a revised rise of 0.2% in the prior month. Additionally, the US seasonally adjusted initial jobless claims advanced to a level of 220.0K in the week ended 10 August 2019, compared to market anticipations for a rise to a level of 212.0K. In the previous week, initial jobless claims had recorded a revised level of 211.0K. Meanwhile, business inventories remained flat on a monthly basis in June. In the previous month, business inventories had climbed 0.3%.

In the Asian session, at GMT0300, the pair is trading at 1.1099, with the EUR trading 0.10% lower against the USD from yesterday’s close.

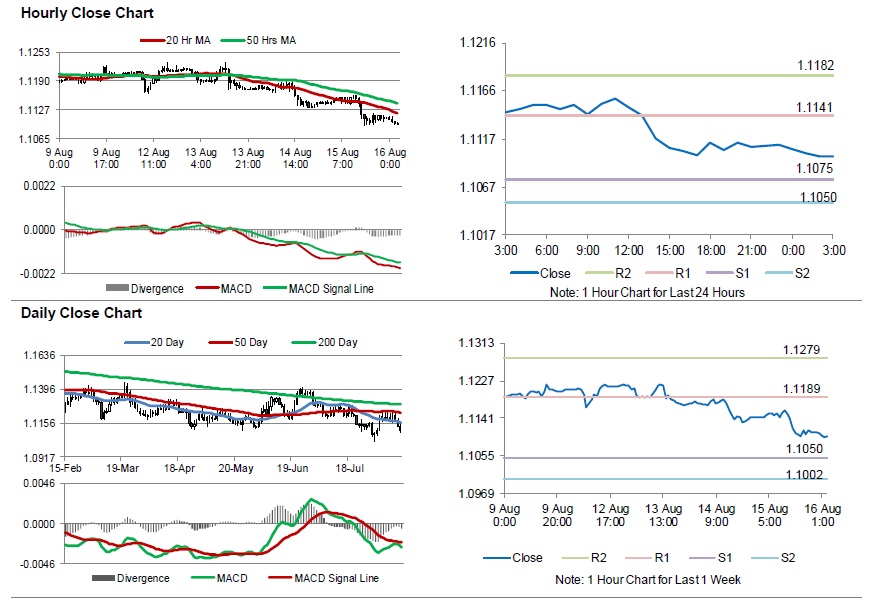

The pair is expected to find support at 1.1075, and a fall through could take it to the next support level of 1.1050. The pair is expected to find its first resistance at 1.1141, and a rise through could take it to the next resistance level of 1.1182.

Moving ahead, traders would await the Euro-zone’s trade balance for June, set to release in a few hours. Later in the day, the US housing starts and building permits, both for July along with the Michigan consumer sentiment index for August, will garner significant amount of investors’ attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.